Zama (ZAMA)是一個開創性的密碼學協議,將全同態加密(FHE)技術帶到以太坊等公鏈上。透過允許智能合約在數據保持完全加密狀態下進行處理,Zama解決了區塊鏈的「透明性漏洞」,實現了私密交易、保密DeFi和安全AI。

Zama是首家達到10億美元估值的FHE獨角獸企業,在2025-06-01由Pantera Capital領投的B輪融資後達成此里程碑。截至2026-02-01,Zama已正式推出其主網並完成備受期待的代幣生成事件(TGE)。憑藉其fhEVM技術,Zama讓開發者能夠建構「盲」智能合約,這些應用程式能夠在從未「看到」底層用戶數據的情況下計算結果,為以太坊生態系統帶來機構級別的隱私保護。

在本文中,您將了解Zama是什麼、其革命性FHE驅動的虛擬機如何運作、ZAMA代幣的作用、它如何為網路的「HTTPZ」時代鋪路,以及如何在BingX期貨市場交易ZAMA永續合約。

Zama(ZAMA)是什麼?主打區塊鏈隱私的加密協議介紹

Zama是一家開源密碼學公司,開發全同態加密(FHE)解決方案以封閉「明文暴露窗口」。在傳統計算和公鏈中,數據必須被解密才能處理。這個解密時刻是一個漏洞,駭客、服務提供商或惡意節點可以在此時存取敏感資訊。

Zama的技術允許端到端的計算加密,意味著數據即使在被AI模型或智能合約使用時也保持加密狀態。Zama將此稱為HTTPZ,這是網路的零知識/保密演進,類似於HTTPS如何使數據傳輸變得安全。

Zama通過三個核心支柱運作:

1. fhEVM(全同態EVM):一個專門的智能合約引擎,允許以太坊相容鏈直接在鏈上處理加密數據。

2. TFHE-rs & Concrete:一套高效能程式庫和編譯器,將標準程式碼(Rust、Python、Solidity)翻譯成加密電路。

3. 保密基礎設施:由KMS和FHE節點等獨立營運商組成的網路,在從未獲得原始數據存取權的情況下驗證和處理加密計算。

在2026年初,Zama透過舉辦一場保密的封閉競價荷蘭拍賣證明了其擴展性,該拍賣吸引了超過11,000名競標者,最終以每代幣0.05美元的價格結算。這是首次完全在鏈上進行的重大代幣發行,且沒有揭露個別競標規模,防止了機器人搶跑和搶先交易。

在我們的綜合指南中了解更多關於如何領取Zama空投的資訊。

Zama 網路怎麼運作?fhEVM 和 HTTPZ 是什麼意思?

Zama使用一種稱為TFHE(Torus全同態加密)的FHE獨特變體,用屏蔽狀態取代公鏈的透明狀態。這個過程涉及幾個創新步驟來確保隱私和效能。

1. 可程式自舉

FHE的主要障礙一直是「噪音」。對加密數據的每次計算都會增加數學雜訊,最終使數據變得無法讀取。Zama的突破是可程式自舉,這是一個在計算過程中「刷新」數據並清除噪音而無需解密的過程。在2026年,Zama優化了這個過程,在高端GPU上每次操作耗時不到1毫秒。

2. Solidity中的加密數據類型

Zama讓一般開發者能夠輕鬆使用隱私功能。使用fhEVM程式庫,開發者可以使用新的數據類型,如euint32(加密32位整數)或ebool(加密布林值)。這些類型看起來像一般的Solidity變數,但在數學上是被屏蔽的。

3. 符號執行架構

為了保持Gas費用低廉,Zama將鏈上邏輯與繁重的FHE計算分離。智能合約在主鏈(如以太坊)上「符號性地」執行,而實際的加密繁重工作則卸載到專門的FHE協處理器。

4. 門檻解密

為了確保沒有單一節點能窺視數據,Zama使用門檻多方計算(MPC)網路。只有當13個去中心化KMS節點中的2/3多數同意結果時,特定數據才能為用戶解密。

Zama的主要用例有哪些?

Zama的技術解鎖了一類之前在公鏈上不可能或不安全建構的新應用程式。

1. 保密DeFi

• 反搶跑:這些DEX利用加密技術在交易位於「記憶體池」時保護交易詳情不被公開查看。透過隱藏交易金額和價格直到執行,協議防止了掠奪性機器人跳到訂單前面操縱市場價格。

• 私人信用評分:使用零知識證明或類似技術,借貸平台可以根據您的現實世界金融活動產生可靠性分數。這允許您獲得抵押不足的貸款,而無需向協議暴露您的敏感銀行數據或具體帳戶餘額。

2. 私人穩定幣和支付,如cUSDT/cUSDC:這些保密變體功能類似標準穩定幣,但掩蓋每筆交易的元數據。雖然網路驗證資金存在且沒有被重複花費,但您的具體持有量和轉帳歷史對公共區塊瀏覽器完全不可見。

3. 隱私保護AI

• 醫療診斷:安全飛地或全同態加密允許AI模型在健康數據保持加密狀態時進行分析。這實現了精確的醫療見解和診斷結果,而AI提供商或雲端主機從未存取患者的原始、未加密檔案。

• 身份驗證(DID):去中心化ID系統允許您共享特定資格問題的「密碼學是」,而不是文件本身。您可以證明符合特定標準,如年齡或公民身份,而驗證方從未看到您的護照或具體出生日期。

4. 現實世界資產(RWA)代幣化:機構平台實現高價值資產(如債券或房地產)的鏈上移動,同時保持企業機密。這允許企業受益於區塊鏈效率,而不會向競爭對手的窺視之眼暴露其龐大部位或專有策略。

ZAMA 代幣有什麼用途?隱私智能合約的應用場景有哪些?

ZAMA代幣是保密計算網路的經濟引擎。在2026年初公開發行後,代幣發揮幾個關鍵功能:

• 交易費用:用戶支付ZAMA來執行保密操作。協議使用銷毀鑄造模型,其中100%的這些費用被銷毀,創造通縮壓力。

• 抵押和安全:獨立營運商必須抵押ZAMA來運行KMS節點進行密鑰管理和FHE節點進行計算。

• 治理:持有者對協議參數進行投票,如抵押獎勵的通脹率、費用結構和新支援區塊鏈的增加,如針對2026年第二季度的Solana整合。

• 計算獎勵:協議年發行量的5%用於激勵節點提供高速FHE處理。

如何在 BingX 交易 ZAMA/USDT 永續合約?

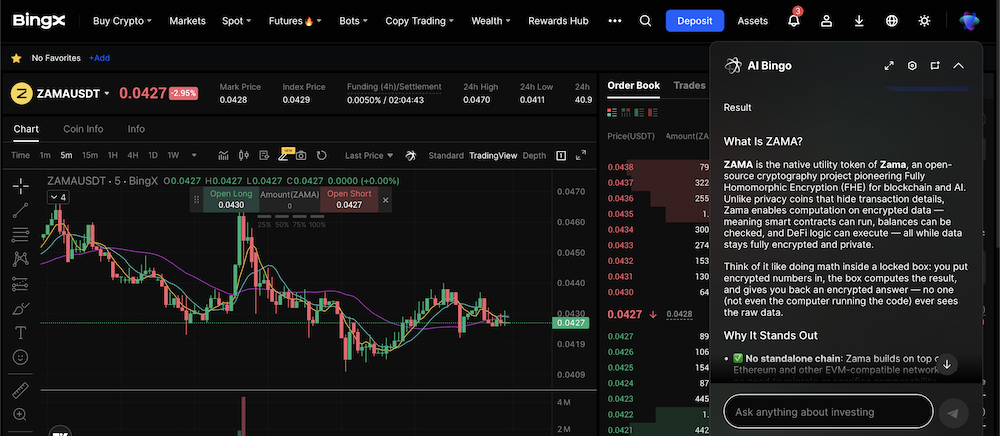

由BingX AI洞察驅動的期貨市場上的ZAMA/USDT永續合約

運用BingX AI的力量,您現在可以即時分析ZAMA的市場情緒和技術模式,幫助您在進行交易之前識別期貨頭寸的最佳進場和出場區域。

2. 選擇ZAMAUSDT交易對:導航到BingX應用程式或網站的「期貨」標籤,搜尋ZAMAUSDT永續合約。

3. 使用BingX AI分析:點選交易螢幕上的BingX AI圖示。詢問問題如「ZAMA的當前趨勢是什麼?」或「ZAMAUSDT的支撐位是多少?」以獲得對您設定的數據支持的第二意見。

4. 選擇保證金模式:選擇全倉保證金(使用整個期貨餘額避免強平)或逐倉保證金(將風險限制在分配給該交易的特定金額)。

5. 設定槓桿:調整槓桿,例如ZAMA的2x到5x。雖然槓桿增加潛在收益,但也顯著增加風險。如果您是Zama生態系統的新手,請從低槓桿開始。

6. 下單:選擇市價單進行即時執行或限價單以特定價格進場。決定是做多(賭價格上漲)還是做空(賭價格下跌)。

8. 監控頭寸:使用「頭寸」標籤即時追蹤未實現盈虧。您可以隨時調整TP/SL或手動平倉。

透過我們的詳細分析了解更多關於如何購買ZAMA的資訊。

投資 ZAMA 前需要注意哪些風險?5 項關鍵評估指標

投資像Zama這樣開創性的隱私基礎設施需要平衡理解其技術「聖杯」潛力和早期市場採用的實際障礙。

1. 硬體和擴展性里程碑:雖然Zama的FHE技術在數學上是安全的且對數據「盲」,但其長期商業成功取決於硬體加速。協議目前處理20 TPS;到2027年達到10,000+ TPS的目標取決於目前正在與硬體合作夥伴生產的專用FHE ASIC(專業晶片)的成功開發。

2. 監管環境和合規:隱私協議經常面臨極端審查,但Zama透過「可程式合規」解決這個問題。這允許開發者將「可審計的隱私」規則直接建構到智能合約中,實現對監管機構的選擇性披露(KYC/AML),而無需向公眾暴露原始用戶數據。

3. 代幣供應和賣壓:2026-02-02的ZAMA代幣發行(TGE)對公開拍賣參與者實現100%的初始解鎖。雖然這確保了即時流動性,但13.2億代幣突然進入流通可能導致顯著的早期價格波動,因為拍賣參與者獲利了結。

4. 機構和散戶估值差距:私人B輪投資者以約10億美元的獨角獸估值進入,而公開拍賣以顯著較低的5.5億美元FDV底價結算。這種「錯誤定價」為散戶創造了獨特的進場點,但也突顯了長期機構支持者和即時二級市場交易者之間激勵對齊的差距。

5. 鏈下依賴和網路安全:雖然狀態更新在鏈上結算,但繁重的加密工作由KMS和FHE營運商的去中心化網路執行。您數據的安全性依賴於這個13節點MPC(多方計算)委員會的完整性及其使用AWS Nitro Enclaves等安全硬體環境。

結語:ZAMA 值得買嗎?2026 年還有成長空間嗎?

Zama位於加密貨幣最重要轉變之一的中心:向保密計算的轉移。憑藉超過10億美元的估值和其突破性的「HTTPZ」模型,如果機構對私人DeFi和AI的需求繼續增長,它將自己定位為關鍵受益者。

然而,ZAMA是一個高科技基礎設施資產,而不是簡單的產息代幣。其價值取決於生態系統增長、FHE ASIC的成功推出以及對隱私的更廣泛市場情緒。如果您在2026年評估ZAMA,請將其視為對明日加密網路的長期投資,並相應管理風險。