Eclipse — це перший

Ethereum Layer 2, який працює на

Solana Virtual Machine (SVM). Розділивши традиційний стек блокчейну, Eclipse забезпечує продуктивність на рівні Solana, високу пропускну здатність і низьку затримку, залишаючись закріпленим до надійної безпеки Ethereum і глибокої ліквідності. В той час як

Ethereum L1 обробляє приблизно 15–30 TPS, паралелізована архітектура SVM Eclipse теоретично масштабується до 65 000 TPS і, станом на початок 2026 року, стабільно підтримує понад 1000 TPS під навантаженням без стрибків комісій. Передаючи

доступність даних до

Celestia, Eclipse підтримує середні комісії за транзакції близько $0,0002, приблизно в 10 000 разів дешевше, ніж Ethereum L1, в той час як локальні ринки комісій забезпечують, що перевантаження в одному додатку не підвищує вартість газу по всій мережі, позиціонуючи Eclipse як високоефективний модульний Layer 2 для dApps, чутливих до продуктивності.

У цій статті ви дізнаєтеся, що таке Eclipse, як працює його унікальна архітектура "SVM на Ethereum", роль токена ES у газі та управлінні, чому це провідний кандидат у гонці за масштабованими ончейн-додатками, і

як купити Eclipse (ES) на BingX.

Що таке Eclipse (ES) SVM-базований Ethereum L2?

Eclipse — це модульний протокол Layer 2, який виконує транзакції, використовуючи SVM, одночасно розрахунковуючись на основній мережі Ethereum. Історично блокчейни були монолітними, тобто один набір вузлів обробляв виконання, розрахунки та зберігання даних. Eclipse розділяє цей стек, спеціалізуючи кожен рівень для досягнення продуктивності інституційного рівня.

Модульний стек: продуктивність за дизайном

Як підключити Ethereum до Solana за допомогою Eclipse | Джерело: Eclipse

Eclipse досягає своєї швидкості "

Solana на Ethereum", інтегруючи найкращі технології на чотирьох різних рівнях:

• Виконання: Працює на SVM, зокрема на двигуні Sealevel, який дозволяє паралельну обробку транзакцій. На відміну від одноланкових роллапів EVM, Eclipse може обробляти неконфліктні транзакції одночасно, націлюючись на пропускну здатність 30 000+ TPS.

• Розрахунки: Захищено Ethereum. Мережа використовує канонічний міст на Ethereum для підтримки найвищого рівня безпеки без довіри і використання пулу ліквідності Ethereum L2 понад $40 мільярдів TVL.

• Доступність даних (DA): Працює на Celestia. Використовуючи спеціальний рівень DA, Eclipse зменшує вартість розміщення даних транзакцій, утримуючи комісії користувачів на стабільному рівні $0,0002 за транзакцію, майже в 10 000 разів дешевше традиційних обмінів Ethereum L1.

• Доведення: Працює на RISC Zero. Eclipse використовує докази шахрайства із нульовим знанням (ZK), дозволяючи мережі вирішувати суперечки стану без необхідності повного повторного виконання транзакцій SVM на Ethereum L1.

З моменту запуску публічної основної мережі в листопаді 2024 року Eclipse перейшов від моделі, орієнтованої на інфраструктуру, до екосистеми, орієнтованої на додатки. Станом на лютий 2026 року мережа підтримує циркулівну пропозицію 132,65 мільйонів ES із повністю розведеною оцінкою (FDV) приблизно $125 мільйонів.

Після стратегічного повороту наприкінці 2025 року команда Eclipse Labs зосередилася на створенні власних "проривних додатків" для стимулювання органічного попиту. Цей зсув має на меті вирішити проблему "порожніх блоків", з якою стикаються багато високопродуктивних L2, зосереджуючи економіку Eclipse на реальному споживчому використанні, а не на інфраструктурних спекуляціях.

Як працює мережа Eclipse?

Eclipse працює як оптимістичний роллап із унікальним підходом. Він замінює стандартну віртуальну машину Ethereum (EVM) на SVM для подолання однопоточних обмежень традиційних L2.

1. Паралельне виконання (SVM)

В той час як EVM обробляє транзакції одну за одною, SVM використовує паралельне виконання. Це дозволяє Eclipse обробляти кілька транзакцій одночасно, поки вони не впливають на той самий стан (рахунок). Теоретично це дозволяє Eclipse масштабуватися до 65 000 TPS, верхньої межі SVM.

2. Модульні розрахунки на Ethereum

Eclipse використовує валідуючий міст на Ethereum. Коли користувачі вносять ETH або активи, вони блокуються на Ethereum і карбуються на Eclipse. Міст забезпечує правильне упорядкування транзакцій і дозволяє користувачам повертатися на

Layer 1, навіть якщо секвенсер Eclipse стане зловмисним або вийде з ладу.

3. Високопропускна DA з Celestia

Для підтримки високого TPS роллап повинен розміщувати багато даних. Поточний "blob" простір Ethereum часто занадто дорогий або обмежений для додатків високої частоти. Eclipse розміщує свої дані транзакцій на Celestia, який спеціально розроблений для високопропускної доступності даних. Це дозволяє Eclipse підтримувати комісії за транзакції на рівні частки цента, приблизно $0,0002.

4. ZK-докази шахрайства через RISC Zero

Більшість оптимістичних роллапів мають 7-денний період оскарження. Eclipse використовує RISC Zero для генерації ZK-доказів шахрайства. Якщо транзакція оскаржується,

ZK-доказ може швидко підтвердити правильний перехід стану без необхідності повторного виконання всієї транзакції SVM на Ethereum L1, значно прискорюючи процес вирішення суперечок.

Які 3 ключові компоненти екосистеми Eclipse?

Eclipse — це не просто технологічний стек; це економіка, розроблена для з'єднання ліквідності Ethereum із інструментами розробників Solana.

1. tETH (Уніфікований токен рестейкінгу): Флагманський DeFi-продукт Eclipse — це tETH, агрегований

рестейкінг токен. Він об'єднує популярні рідкі токени рестейкінгу (LRT) як

ether.fi,

Renzo та

Puffer в один уніфікований актив. Це запобігає фрагментації ліквідності і надає користувачам єдину версію

ETH, що приносить прибуток, для використання в екосистемі Eclipse.

2. Turbo Tap і споживчі додатки: Eclipse отримав масове раннє визнання через Turbo Tap, інтерактивну гру, де користувачі заробляли очки "grass" за стрес-тестування мережі. На початку 2026 року Eclipse Labs повернувся до створення власних "проривних додатків" для стимулювання прямого споживчого попиту на високопропускну інфраструктуру ланцюга.

3. Міжланцюгова сумісність через Hyperlane: Eclipse використовує

Hyperlane для безперешкодного з'єднання як з Ethereum, так і з Solana. Це дозволяє користувачам переносити активи як

USDC,

SOL та

WIF між усіма трьома ланцюгами, роблячи Eclipse основним "хабом" для конвергенції спільнот SOL і ETH.

Для чого використовується токен ES?

Токен ES є нативною утилітарною та управлінською основою мережі Eclipse. Хоча Eclipse спочатку запустився, використовуючи ETH для газу,

токен ES тепер виконує кілька критичних функцій:

• Комісії за газ: Користувачі можуть сплачувати комісії за транзакції в мережі через нативний механізм paymaster.

• Децентралізоване управління: Власники ES голосують за оновлення протоколу, структури комісій та перерозподіл максимальної можливої цінності (MEV).

• Стейкінг і безпека: Власники токенів можуть стейкати ES до додатків або використовувати його для розміщення "облігацій доказу шахрайства" для допомоги в захисті мережі.

• Стимули: 15% від загальної пропозиції 1 мільярда ES виділено на аірдропи та ліквідність для винагороди ранніх користувачів і розробників.

Огляд Eclipse (ES) аірдропу: винагорода для ранніх користувачів

Eclipse (ES) аірдроп був масовим заходом розподілу в спільноті в липні 2025 року, розробленим для децентралізації управління першого SVM-повноваженого Layer 2 Ethereum. Фонд Eclipse виділив 100 мільйонів токенів ES, або 10% від загальної пропозиції 1 мільярда, для ранніх користувачів, які сприяли росту та стабільності мережі.

Право на участь в основному визначалося трьома категоріями: ончейн-активність, такі як участь у стрес-тест грі "Turbo Tap" і перенесення активів, соціальна присутність у X, відстежувана через

аналітику Kaito, і залученість у Discord. Хоча знімок правомочних учасників було зроблено в квітні 2025 року, офіційний портал для отримання відкрився 16 липня 2025 року і залишався активним до 15 серпня 2025 року, дозволяючи користувачам отримати свої винагороди в мережах Eclipse, Ethereum та Solana.

Щоб дізнатися більше про конкретні кроки для перевірки ваших винагород і вплив цієї події на економіку Eclipse, перегляньте наш спеціальний посібник про

Eclipse аірдроп.

Що таке токеноміка Eclipse (ES)?

Токен ES працює з фіксованою загальною пропозицією 1 000 000 000 ES, з приблизно 145 100 000 ES (14,5% від загальної кількості) в обігу станом на лютий 2026 року.

Розподіл токенів ES

Розподіл токенів Eclipse (ES) | Джерело: блог Eclipse

• Екосистема та розробка (35%): Виділено на фінансування досліджень і розробок, критичної інфраструктури та резервів фонду для підтримки довгострокового росту протоколу.

• Ранні прихильники та інвестори (31%): Розподілено серед ранніх інвесторів, які надали необхідне фінансування для початку проєкту.

• Учасники (19%): Зарезервовано для нинішніх і майбутніх членів команди, відповідальних за створення та масштабування протоколу Eclipse.

• Аірдроп і ліквідність (15%): Складається з 10% для спільнотних аірдропів (із 6,1%, випущених у сезоні 1) та 5% для підтримки торгової ліквідності на біржах.

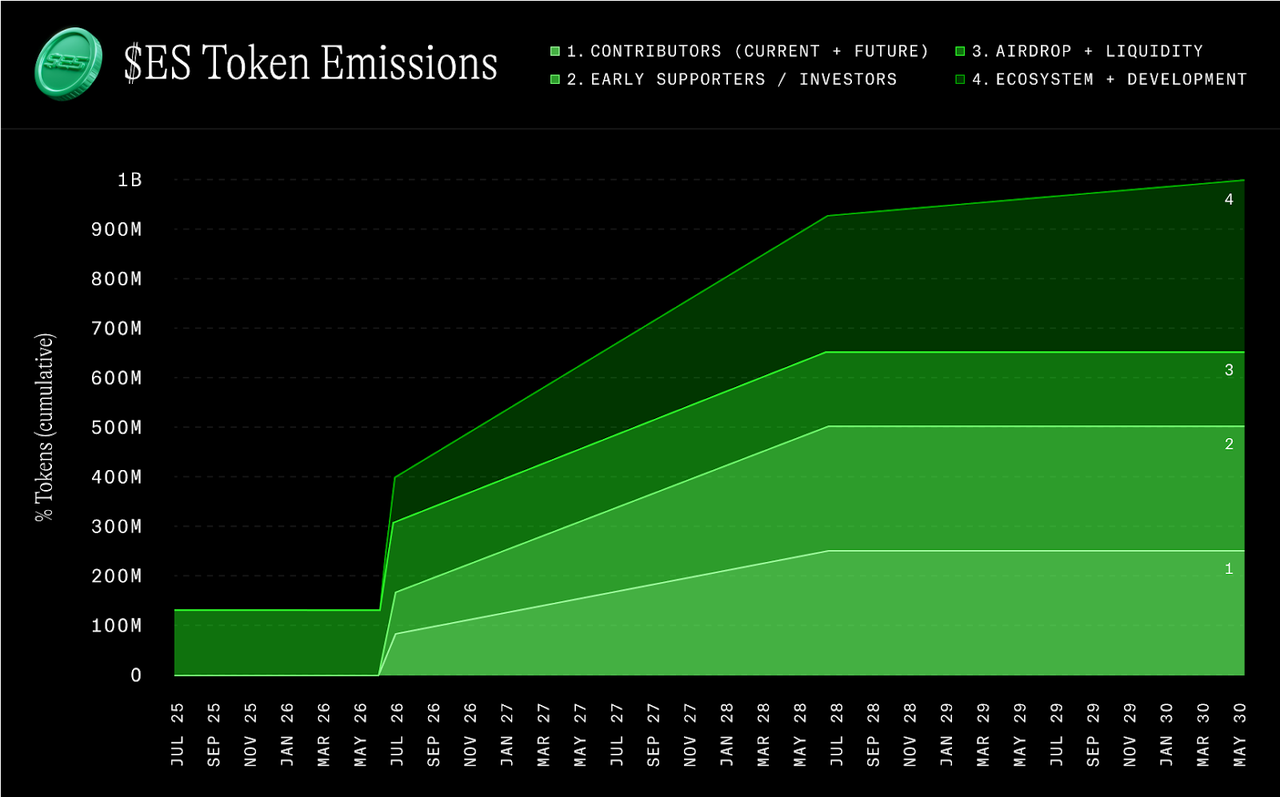

Графік вестингу та розблокування ES

Графік вестингу ES | Джерело: блог Eclipse

Щоб запобігти затопленню ринку та забезпечити зобов'язання, Eclipse запровадив суворий графік вестингу. Більшість токенів підлягають багаторічним блокуванням, які узгоджуються з довгостроковою дорожньою картою проєкту.

• Аірдроп і ліквідність: 100% початкових 150 мільйонів ES було розблоковано на події генерації токенів (TGE) 16 липня 2025 року для початкової активності мережі та торгівлі.

• Ранні прихильники та інвестори: Ці токени підлягають 3-річному блокуванню. Після 1-річного кліфу, що закінчується в липні 2026 року, вони почнуть лінійне щомісячне вестування протягом наступних 24 місяців.

• Учасники (команда): Ця пайова частка підлягає 4-річному графіку вестингу з 3-річним блокуванням. Подібно до інвесторів, команда побачить своє перше великі розблокування в липні 2026 року, а потім 24 місяці лінійного розподілу.

• Екосистема та розробка: Керується фондом, ці токени розблоковуються за потребою для грантів протоколу, витрат на інфраструктуру та стимулів екосистеми, зазвичай слідуючи довгостроковому випуску на основі віх.

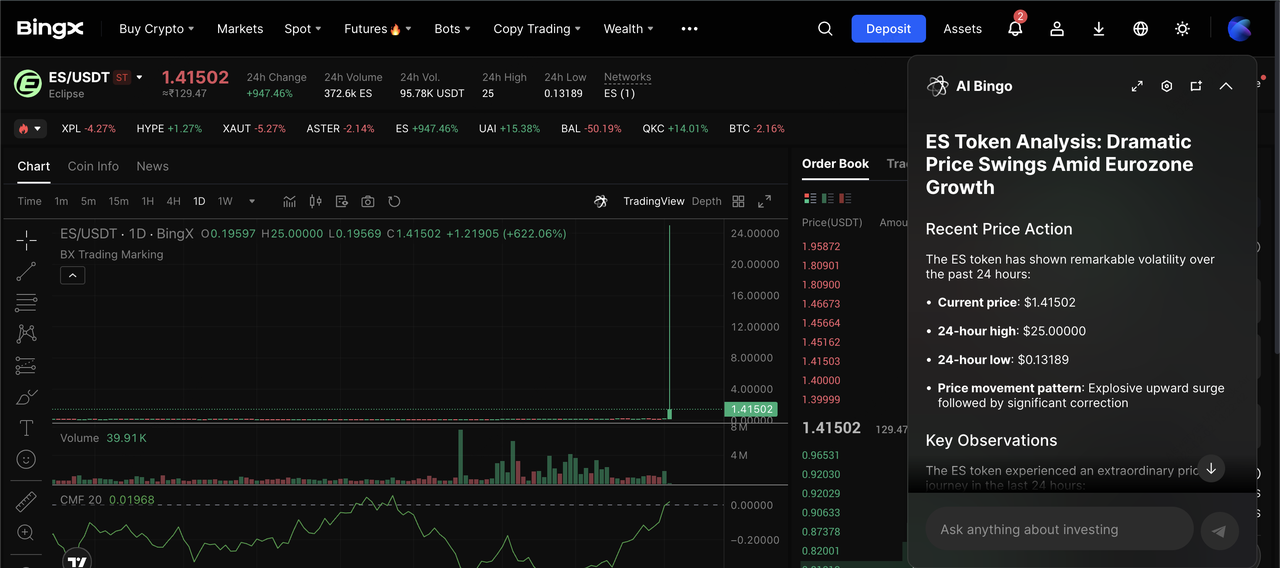

Як купувати та продавати токени Eclipse (ES) на спотовому ринку BingX

На базі інсайтів BingX AI ви можете ефективно торгувати ES та іншими токенами модульної екосистеми, використовуючи ринкові сигнали в реальному часі.

Торгова пара ES/USDT на спотовому ринку на базі інсайтів BingX AI

2. Перейдіть до спотового ринку: Знайдіть торгову пару

ES/USDT.

ТОП-3 міркування перед інвестуванням у Eclipse (ES)

Оцінка Eclipse вимагає чіткого розуміння її високого ризику технічного поворту та агресивного конкурентного ландшафту 2026 року.

1. Ризик виконання та стратегічний поворот: Хоча Eclipse використовує високопродуктивну архітектуру SVM, проєкт зазнав значної реструктуризації наприкінці 2025 року, звільнивши 65% свого персоналу та повернувшись від нейтрального постачальника інфраструктури до студії, що створює власні "проривні додатки". Інвестори повинні стежити за тим, чи зможе це нове керівництво успішно запустити ці власні додатки для стимулювання органічного попиту, особливо після повідомленого 95% зниження загальної заблокованої вартості екосистеми (TVL) з піку 2025 року.

2. Жорстка конкуренція SVM L2: Eclipse більше не має монополії на наратив "Solana на Ethereum". Конкуренти як

SOON (Solana Optimistic Network) та Atlas вийшли на ринок із спеціалізованими реалізаціями SVM, конкуруючи за той же пул розробників і ліквідності. Успіх $ES залежить від здатності Eclipse зберегти свою перевагу першопрохідця і довести, що його специфічний модульний стек, що використовує Celestia для доступності даних, пропонує кращу економічну ефективність порівняно з цими новими конкурентами.

3. Токеноміка та тиск розблокування: Станом на початок 2026 року більшість пропозиції токенів ES залишається заблокованою. Значним фактором ризику є надходящий кліф у липні 2026 року, коли майже 50% загальної пропозиції, виділеної команді та раннім інвесторам, почне лінійне щомісячне розблокування. Без масового зростання адаптації стейкінгу або корисності мережі для поглинання цієї нової пропозиції токен може зіткнутися з тривалим тиском на зниження ціни незалежно від технічної продуктивності мережі.

Заключні думки: чи варто купувати Eclipse (ES) у 2026 році?

З розгортанням 2026 року Eclipse знаходиться у вирішальній точці перегину. Його основна технологія, SVM, що працює на Ethereum, залишається технічно вражаючою, але інвестиційний наратив зсунувся від потенціалу інфраструктури до ризику виконання. Після різкого скорочення активності екосистеми майбутнє Eclipse тепер залежить від того, чи може його поворот від нейтрального постачальника роллапів до власного розробника додатків перетворитися на реальне користувацьке прийняття.

З інвестиційної перспективи $ES найкраще розглядати як високоризиковану ставку, залежну від результату. Потенціал зростання залежить від успіху флагманських додатків Eclipse Labs у 2026 році та їхньої здатності стимулювати стійкий попит на $ES як газовий токен, тоді як ризики зниження включають великий розкрив токенів у липні 2026 року, триваючу стагнацію екосистеми та зростаючу конкуренцію з боку новіших роллапів на основі SVM. Це спекулятивний актив, який вимагає ретельного моніторингу відновлення TVL, активних користувачів і тяги продуктів, а не довгострокових припущень.

Схожі матеріали