La ruée vers l'or des

Actifs du Monde Réel (RWA) de 2026 a officiellement frappé l'écosystème

Solana, menée par le très explosif et hautement controversé

U.S. Oil (USOR). Malgré un retracement massif de 82% depuis son pic de fin janvier à 0,0839 $, USOR reste en hausse de 406 349% par rapport à son plus bas historique d'il y a moins d'un mois. Pour les plus de 114 000 détenteurs qui suivent cette tokenisation à haute vélocité des réserves énergétiques nationales, la volatilité est à la fois un avertissement et un aimant.

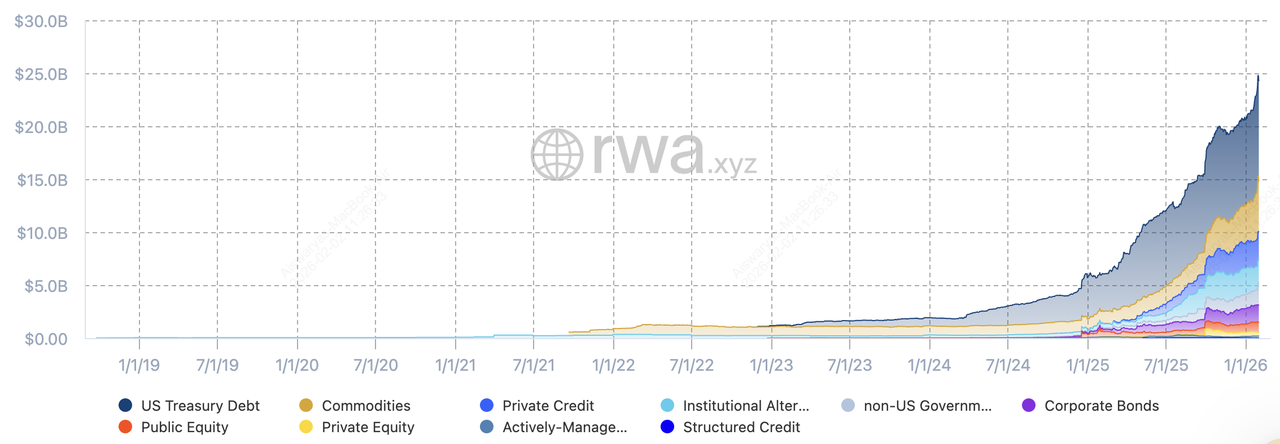

Valeur totale des actifs RWA tokenisés | Source : RWA.xyz

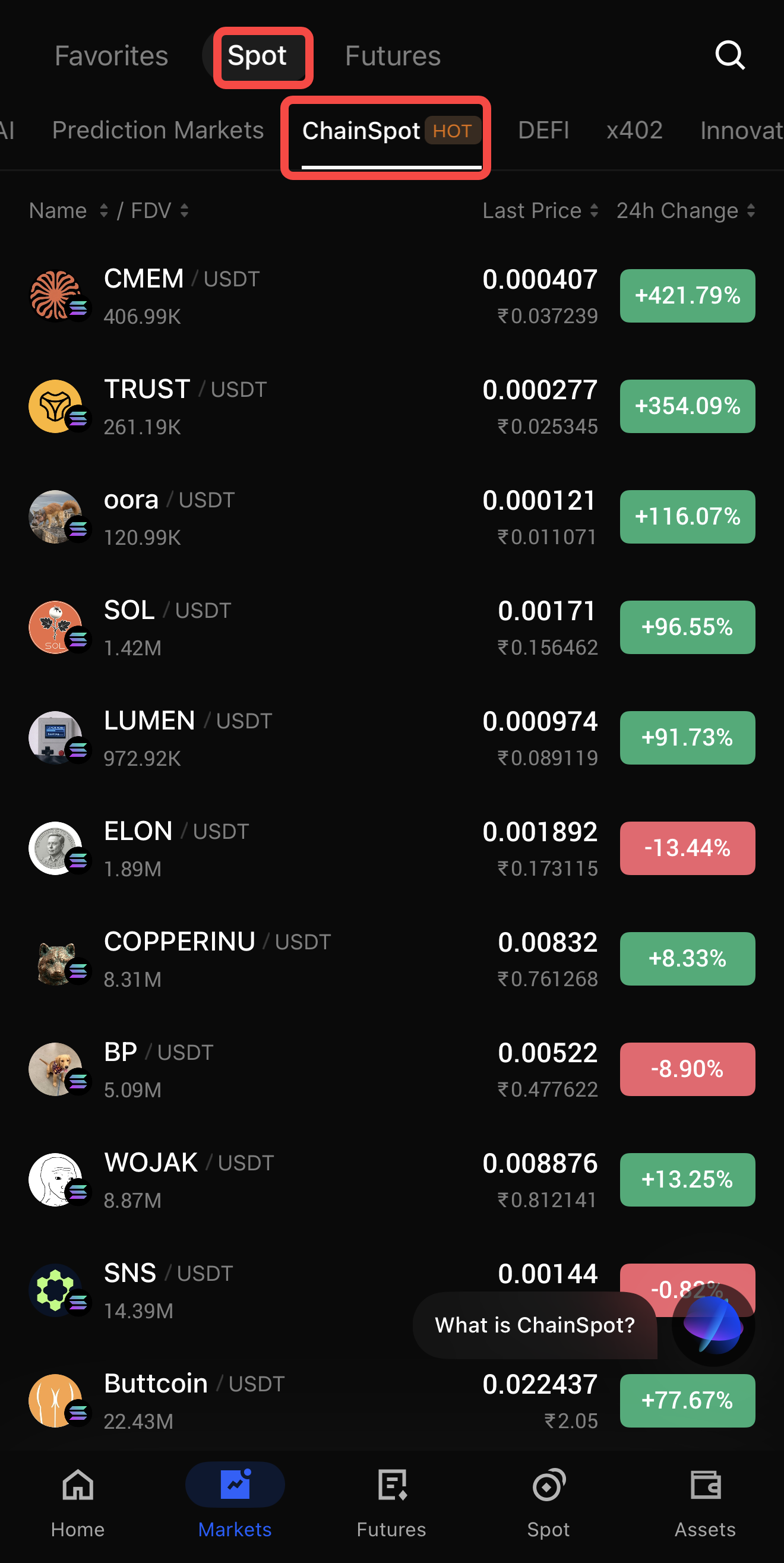

Pour naviguer dans ces eaux CeDeFi sans la complexité du bridging manuel ou de la sécurité des clés privées,

BingX ChainSpot offre une passerelle professionnelle pour trader l'élan RWA avec la facilité centralisée et l'avantage décentralisé. Ce guide explore les étapes essentielles pour acheter USOR sur BingX ChainSpot, vous permettant de maîtriser le narratif Solana "adossé au pétrole" tout en gérant les risques de haute volatilité d'USOR en 2026.

Qu'est-ce que U.S. Oil Reserve (USOR) ?

U.S. Oil Reserve (USOR) est un token SPL natif de Solana qui a fait ses débuts au début de janvier 2026, se positionnant comme une "Réserve Pétrolière de l'Ère Numérique". Le projet prétend offrir un indice

on-chain haute vitesse et transparent pour les

actifs pétroliers du monde réel, avec une offre fixe de 1 000 000 000 de tokens.

Le projet se distingue par un tableau de bord "Reserve Board" qui suit une Valeur de Réserve Indicative, récemment rapportée à 803 020 $ début février 2026. Selon le marketing du projet, cette valeur est soutenue par un trésor diversifié d'actifs à haute liquidité incluant

Bitcoin BEP-20 (BTCB) à 54,6%,

Ethereum (ETH) à 19,2%, et

XRP à 13,4%. Bien que la plateforme utilise des mots-clés comme "Gov-verified" et "Federal Custody", il est crucial de noter que le Département américain de l'Énergie (DOE), l'agence réelle gérant la Réserve Stratégique de Pétrole, n'a ni vérifié ni approuvé ce projet.

Comment fonctionne le token USOR : Narratif vs Réalité technique

Aperçu des réserves USOR | Source : USOR.tech

Techniquement, USOR fonctionne comme un actif de finance décentralisée (DeFi) standard sur Solana, avec une liquidité principalement acheminée via l'agrégateur DEX Jupiter.

• Indice on-chain : Le projet commercialise $USOR comme un "actif de réserve" plutôt qu'un memecoin, prétendant que chaque baril est réconcilié contre un registre on-chain.

• Modèle adossé au trésor : Au lieu de barils de pétrole physiques, la "réserve" consiste actuellement en un panier de cryptomonnaies blue chip. Par exemple, au 2 février 2026, le leader du trésor est BTCB (Bitcoin BEP2), rendant la valeur du token plus dépendante de la santé du marché crypto que des futures du pétrole brut.

• Moteurs spéculatifs : Le "hype" est largement alimenté par des affirmations non vérifiées d'endorsements politiques et d'activité de wallets institutionnels "liés à BlackRock". En pratique, USOR se trade comme un token narratif à haute volatilité qui réagit fortement aux gros titres géopolitiques et aux rumeurs de jalons de "tokenisation pétrolière", comme le déploiement largement discuté du 1er février.

Décoder la hausse de 400 000% d'USOR : Top 3 des raisons derrière le hype

L'intérêt explosif pour USOR n'est pas simplement le produit d'une spéculation aléatoire ; c'est le résultat d'une "tempête parfaite" de timing géopolitique et de liquidité narrative.

1. Symbolisme "Meme" géopolitique : USOR a exploité avec succès le sentiment pro-crypto de "l'ère Trump". Les rumeurs d'étiquettes de wallet "Trump Team", identifiées via des heuristiques on-chain, ont généré un gain de 600% mi-janvier 2026. Les traders ont traité USOR comme un proxy à fort effet de levier pour l'indépendance énergétique américaine, avec des mentions sur les réseaux sociaux sur X (anciennement Twitter) augmentant de 450% dans la semaine précédant son pic.

2. La frontière RWA : Alors que la capitalisation du marché RWA mondial approchait les 25 milliards de dollars début 2026, USOR s'est positionné à l'intersection des matières premières énergétiques et de la blockchain. Tandis que le

pétrole (WTI) physique se tradait près de 60 $ le baril, USOR offrait aux investisseurs de détail un moyen de trader des "barils numériques" sans la complexité des futures traditionnels ou des ETF, captant l'attention de l'écosystème DeFi de 1,5 billion de dollars.

3. Liquidité extrême et volatilité d'élan : À son pic le 21 janvier 2026, USOR a atteint un volume de trading sur 24h de 27,4 millions de dollars avec une capitalisation boursière dépassant 55 millions de dollars. Ce chiffre d'affaires massif, inhabituellement élevé pour un microcap Solana, a créé une "boucle de hype" auto-renforcée. Les spéculateurs à fort effet de levier ont été attirés par sa volatilité quotidienne de 295%, considérant le token comme un véhicule principal pour la rotation rapide de capital pendant la stagnation du marché crypto plus large.

Comment acheter USOR sur BingX ChainSpot : Guide étape par étape

Acheter U.S. Oil Reserve (USOR) via BingX ChainSpot est le moyen le plus efficace d'accéder à cet actif Solana à haute volatilité sans avoir besoin de

portefeuilles Web3 externes ou de bridging. En utilisant les guides séparés suivants pour le Web et l'App, vous pouvez assurer une expérience de trading fluide tout en tirant parti de la sécurité CeDeFi de ChainSpot.

Comment trader les tokens USOR sur BingX ChainSpot (Web)

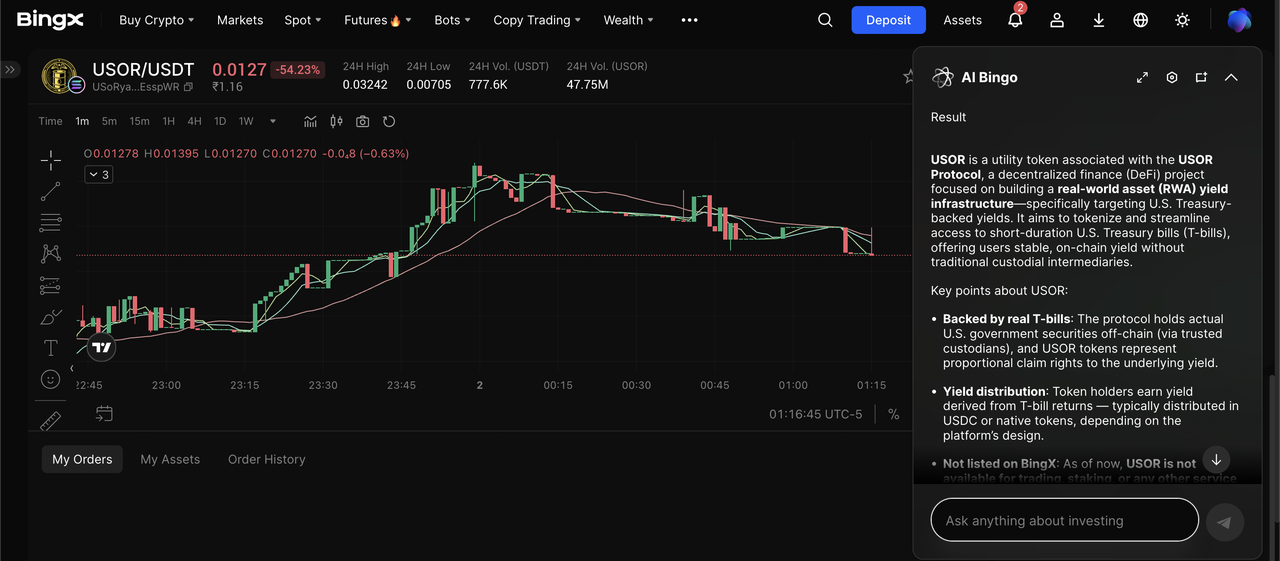

Paire de trading USOR/USDT sur le marché ChainSpot alimenté par BingX AI

La version desktop de BingX fournit une vue complète des métriques on-chain comme les tendances des détenteurs et le suivi des P&L, la rendant idéale pour une analyse approfondie.

2. Naviguez vers ChainSpot : Survolez l'onglet Spot dans la barre de navigation supérieure et sélectionnez

ChainSpot. Si demandé, complétez le questionnaire de risque unique pour activer le trading on-chain.

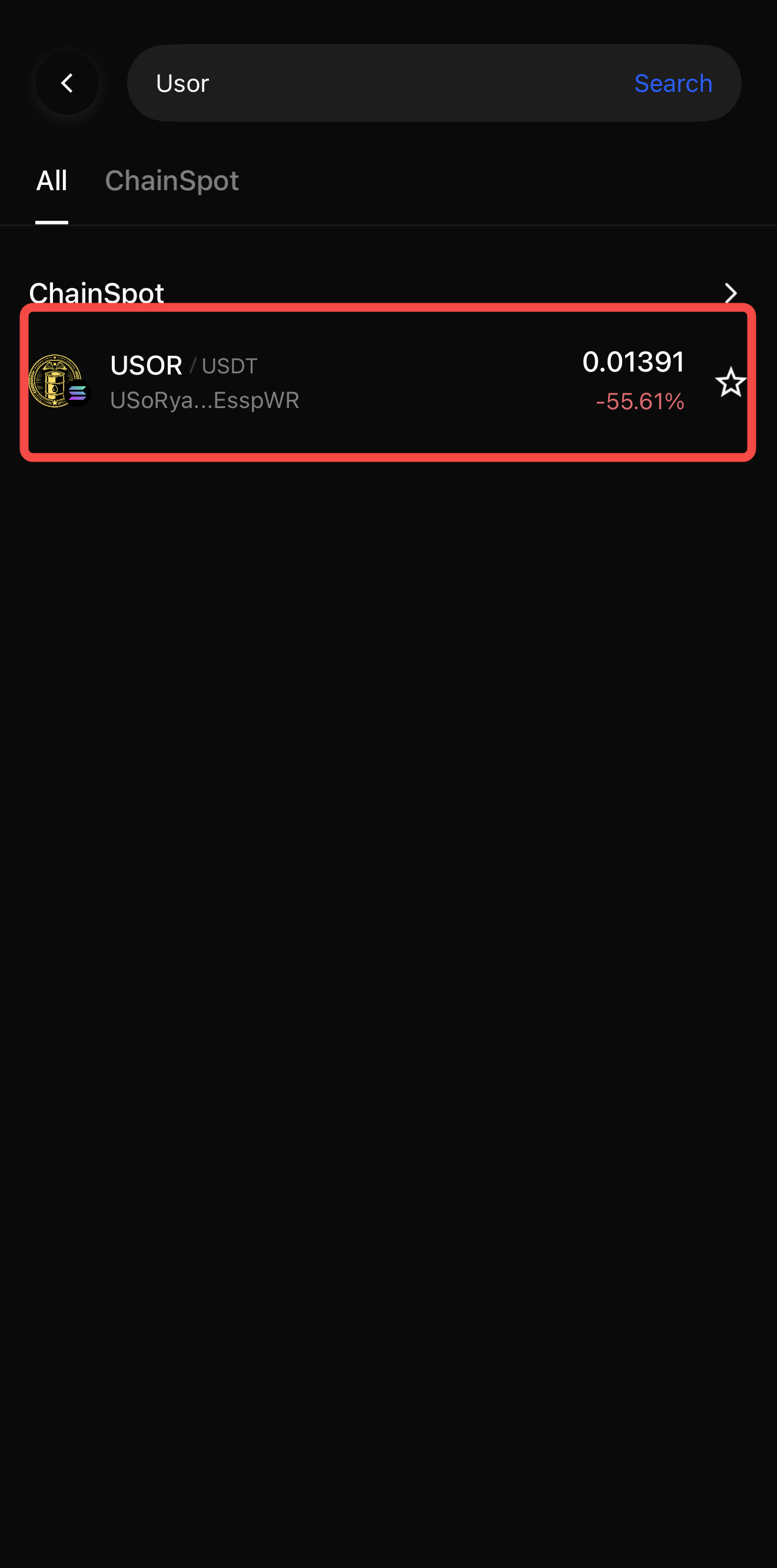

3. Recherchez et vérifiez : Utilisez la barre de recherche et entrez "USOR".

Conseil Pro : Vérifiez toujours l'adresse du contrat USoRyaQjch6E18nCdDvWoRgTo6osQs9MUd8JXEsspWR

pour éviter les tokens copycat malveillants.

4. Configurez le Swap : Sélectionnez la paire

USOR/USDT. Entrez le montant d'USDT que vous souhaitez dépenser. Dans les paramètres, assurez-vous que "Auto Slippage" est sélectionné ; cela permet à l'AI de gérer la volatilité extrême typique d'USOR pour un taux de succès plus élevé.

5. Exécutez & Suivez : Vérifiez les frais de gaz estimés, déduits en USDT, et cliquez sur Acheter USOR. Une fois confirmé, suivez votre prix de revient moyen et vos P&L non réalisés directement dans le tableau de bord.

Comment acheter et vendre le coin USOR sur BingX Chain (App)

L'App BingX (v4.58 ou plus récente) est optimisée pour la rapidité, vous permettant de réagir aux gros titres géopolitiques et aux pics de prix en déplacement.

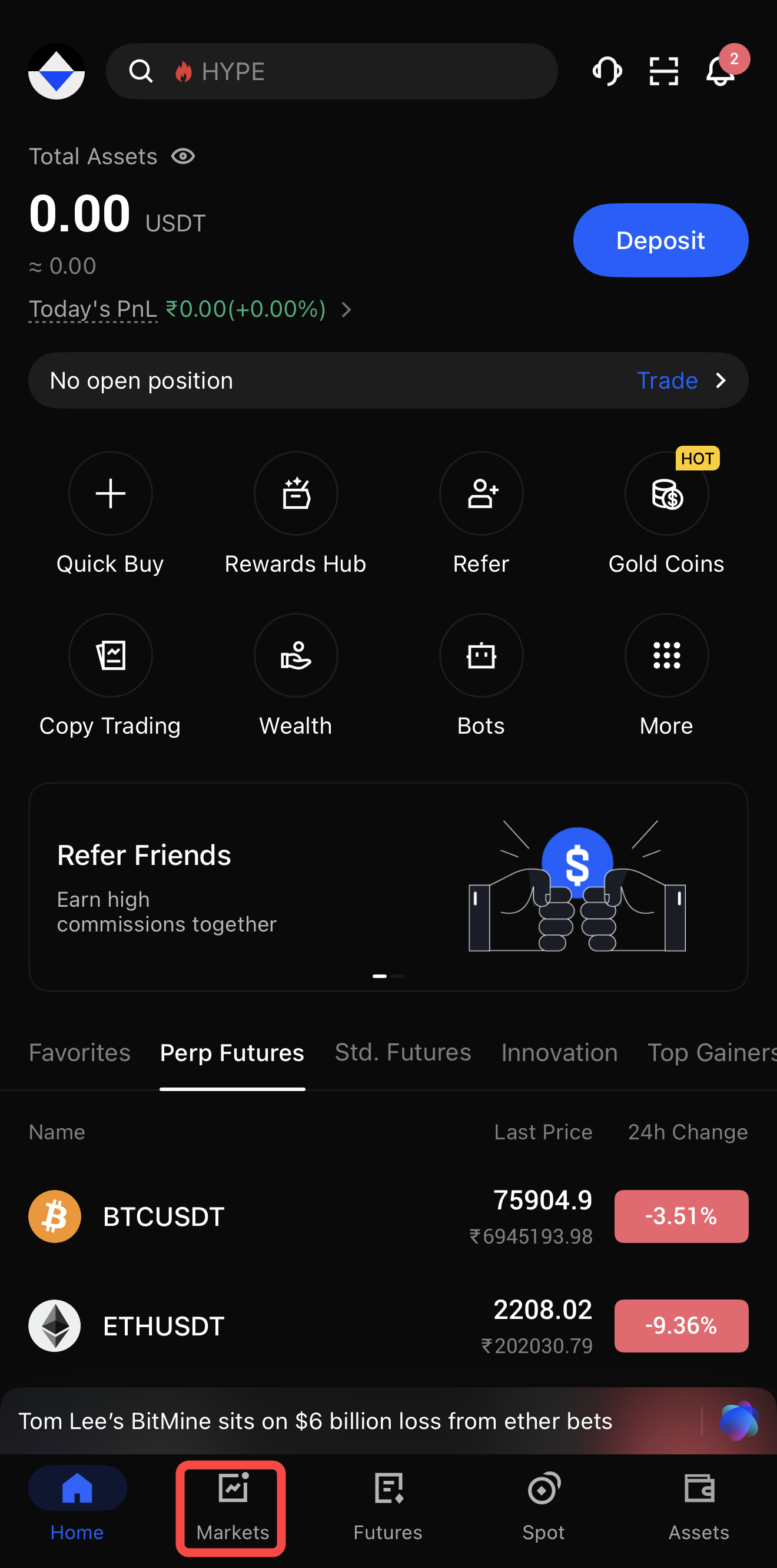

1. Vérifiez votre statut : Ouvrez l'App BingX. Appuyez sur votre icône de profil pour vérifier que votre vérification d'identité est au Niveau 2. Allez à vos Actifs pour vous assurer que votre USDT est dans le portefeuille Spot.

2. Accédez à ChainSpot : Appuyez sur l'onglet Spot en bas de l'écran. Dans les icônes de fonctionnalités sous le graphique de prix, appuyez sur ChainSpot.

3. Localisez USOR : Appuyez sur l'icône de recherche en haut à droite. Entrez "USOR" et sélectionnez le token officiel. Vous pouvez aussi le trouver sous les catégories "Tendances" ou "Solana" s'il a actuellement un volume élevé.

4. Passez votre ordre : Saisissez votre montant USDT. Appuyez sur l'engrenage des paramètres pour vérifier que "Auto Slippage" est activé. Ceci est crucial pour USOR car la liquidité mince peut souvent mener à des transactions échouées en mode manuel.

5. Confirmez et visualisez : Appuyez sur Swap et confirmez la transaction. Les tokens seront automatiquement crédités sur votre compte Spot. Vous pouvez voir vos avoirs en allant aux Actifs et Spot et en cherchant USOR.

5 Risques clés à considérer avant d'acheter le token U.S. Oil Reserve (USOR)

Avant de trader USOR, il est crucial de séparer le narratif viral de la réalité technique et légale de l'actif. Début 2026, les risques suivants définissent l'écosystème USOR :

1. Aucune preuve d'adossement aux matières premières : Malgré les affirmations du projet de "réserves vérifiées par le gouvernement" et de "custody fédérale", il n'y a aucune preuve légale ou financière qu'USOR soit adossé au pétrole brut physique. Le Département américain de l'Énergie (DOE), qui gère la Réserve Stratégique de Pétrole (SPR), n'a émis aucune autorisation pour ce token. Traitez toute mention de "barils numériques" comme un narratif marketing plutôt qu'une matière première échangeable.

2. Volatilité high-beta & "Cascades de liquidité" : USOR présente une sensibilité extrême aux gros titres géopolitiques. Après le "déploiement de tokenisation" non vérifié du 1er février 2026, le token a subi un crash de 70% en quelques heures. Cette "cascade de liquidité" se produit lorsque les carnets d'ordres minces sur les

DEX Solana ne peuvent absorber les ordres de vente, menant à un glissement massif où le prix d'exécution est significativement inférieur au taux de marché.

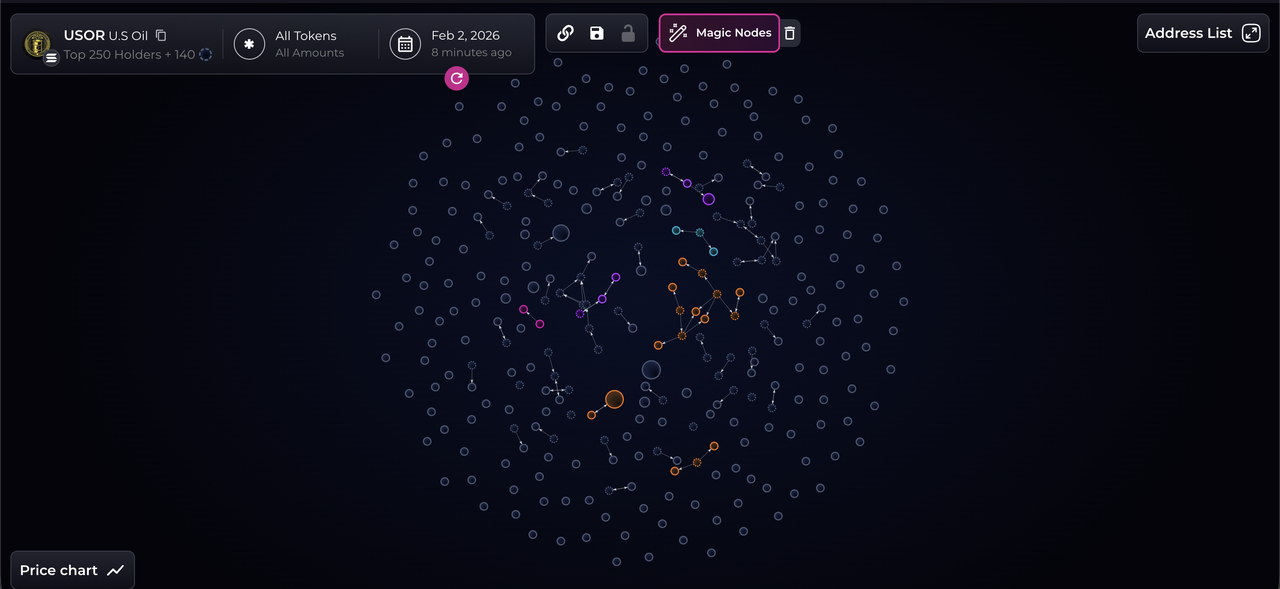

Analyse on-chain d'USOR sur Bubblemaps

3. Concentration de l'offre fantôme : L'analyse on-chain de Bubblemaps révèle que plus de 26,18% de l'offre est détenue dans des clusters interconnectés liés aux déployeurs du projet. Ceci crée un "Risque de Baleine" sévère ; bien que le projet ait plus de 114 000 détenteurs, un petit groupe d'initiés détient suffisamment d'offre pour faire crasher le prix près de zéro (support à 0,0042 $) s'ils choisissent de sortir simultanément.

4. Statut de "zone grise" réglementaire : Contrairement à un ETF pétrolier réglementé ou un futur de matière première enregistré, USOR opère sans surveillance de la SEC ou CFTC. En cas de "rug pull" ou d'échec de smart contract, les investisseurs n'ont aucun recours légal ou protections d'assurance typiquement trouvées dans les marchés énergétiques traditionnels.

5. Risque d'étiquetage heuristique : Les rumeurs populaires concernant les wallets "liés à BlackRock" ou "Trump Team" achetant USOR sont basées sur un étiquetage heuristique piloté par l'IA, pas des divulgations officielles. Ces étiquettes peuvent être facilement manipulées en "dustant" des wallets de haut profil pour créer un faux sentiment d'accumulation institutionnelle.

Conclusion

Acheter USOR sur BingX ChainSpot est la méthode la plus pratique pour les débutants d'obtenir une exposition à ce narratif Solana tendance sans la complexité des portefeuilles DeFi. Cependant, la commodité n'élimine pas le risque. En février 2026, USOR reste un token high-beta, piloté par le sentiment. Utilisez toujours des tailles de position conservatrices et n'investissez jamais plus que ce que vous pouvez vous permettre de perdre dans les actifs lourds en narratif.

Lectures connexes