zkPass (ZKP) is a Web3 protocol focused on enabling privacy-preserving verification of real-world internet data on-chain. Built around the zkTLS narrative, it aims to address the long-standing challenge of bringing Web2 data into blockchain environments without requiring users to upload documents or expose sensitive information. As privacy and compliance become more important across the crypto ecosystem, zkPass has also entered the trading spotlight and is available for spot trading on centralized platforms like BingX, making it accessible to a broader global user base.

The emergence of zkPass reflects a broader shift in Web3 toward building a more verifiable internet. This article explores why zkPass has gained attention, how it fits into the evolving

zero-knowledge and zkTLS landscape, and what users should understand before diving deeper into how the protocol works.

What Is zkPass (ZKP)?

Source: zkPass Website

zkPass is a decentralized oracle protocol designed to turn private internet data into verifiable, privacy-preserving proofs on-chain. While traditional oracle networks focus on delivering public data such as token prices to smart contracts, zkPass targets the much larger private data market, which includes personal financial records, identity attributes, and other sensitive information that has historically been inaccessible to blockchains.

The core idea behind zkPass is to let users prove facts from any HTTPS website, such as meeting an age requirement, holding a minimum bank balance, or owning a verified social media account, without revealing the underlying data itself. No raw information, passwords, or identity documents are shared. By separating verifiability from visibility, zkPass creates a trust layer for

DeFi,

AI applications, and decentralized identity systems while allowing users to retain full control over their personal information.

By early 2026, zkPass had expanded its capabilities through the TransGate infrastructure, which allows standard websites to act as verifiable data sources without requiring site owners to build custom APIs. This makes the protocol broadly compatible with today’s internet. As a result, zkPass has evolved beyond an individual privacy tool into a compliance-focused solution, enabling institutions to validate identity and financial status in ways that align with global data protection frameworks such as GDPR.

How Does zkPass Work?

At its core, zkPass is a decentralized, privacy-preserving oracle protocol designed to verify private internet data on-chain. Unlike traditional oracles that primarily deliver public information such as price feeds, zkPass focuses on enabling verifiable access to sensitive data while maintaining strict privacy guarantees. The protocol relies on a combination of three core technologies to achieve this.

1. 3P-TLS (Three-Party Transport Layer Security)

Standard HTTPS communication involves two parties: the user and the website. zkPass extends this model by introducing a third participant, a decentralized MPC node, into the TLS handshake. This allows the network to verify that the data originates directly from the source server, such as a bank or government portal, while ensuring that private credentials, passwords, and raw data are never exposed to the node.

2. MPC (Multi-Party Computation)

Multi-Party Computation ensures that the verification process remains decentralized. Instead of relying on a single verifier, multiple nodes jointly perform the validation. No individual participant has access to the complete dataset, eliminating centralized trust assumptions and reducing the risk of data leakage or single points of failure.

3. Zero-Knowledge Proofs (ZKP)

After the data is verified, a

zero-knowledge proof is generated locally on the user’s device, such as a browser or mobile application. This proof confirms that predefined conditions are satisfied, for example meeting an age requirement or holding a minimum account balance, without revealing the underlying personal data itself.

The outcome of this process is a zkSBT (Zero-Knowledge Soulbound Token) or cryptographic attestation that can be used across DeFi, SocialFi,

gaming, and identity-driven applications, enabling on-chain verification while preserving user privacy.

Why Did ZKP Price Jump Over 30% in February 2026: Key Drivers Explained

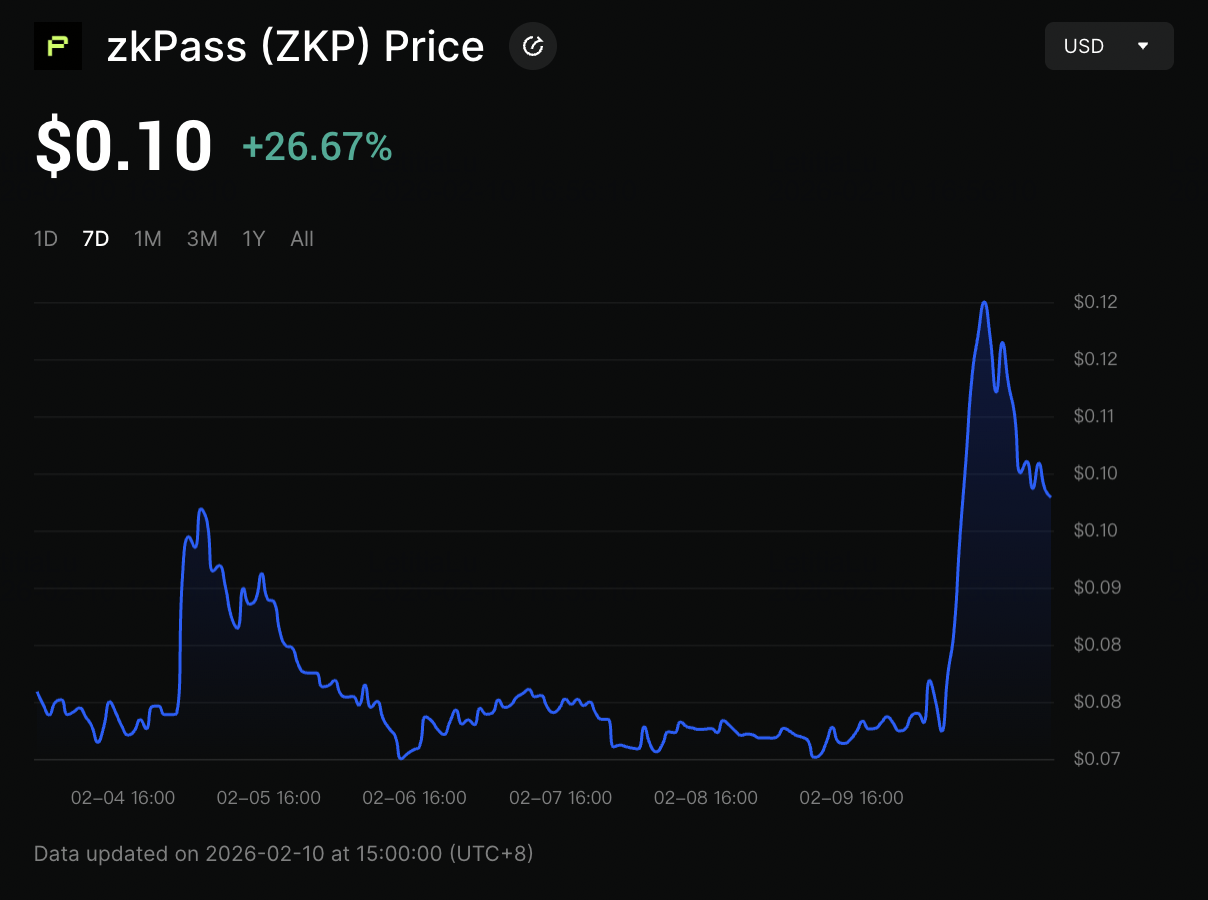

As of February 10, 2026, the ZKP token has surged more than 30%, driven by aggressive spot buying and a series of high-impact ecosystem developments. The move reflects renewed market attention around zkPass and the broader zkTLS narrative, with several short-term catalysts contributing to the breakout.

Source: BingX zkPass Price

1. 7.4 Million ZKP Prize Pool: On February 9, 2026, zkPass officially unveiled a massive 7.4 million ZKP Token Voucher Prize Pool. This major spotlight event has sparked a massive onboarding wave as traders accumulate ZKP to qualify for giveaway tiers, effectively clearing sell-side liquidity.

2. 3,700% Volume Spike on South Korean Exchanges: Trading volume has exploded by 3,788% in 24 hours, exceeding $200 million. This activity is led by global exchanges and major South Korean platforms like Upbit, where a high-conviction "Upbit effect" is driving the ZKP/KRW pair to a premium.

3. Technical Reversal from Local Bottom: After hitting a bottom of $0.073 on February 6, ZKP saw its highest buying volume in history. Reclaiming the $0.10 psychological level today triggered a wave of short liquidations, accelerating the vertical move toward new quarterly highs.

4. Sustained 2025 Privacy Sector Momentum: The current surge is also a continuation of the massive performance seen across the privacy sector throughout 2025. As regulatory scrutiny increased globally last year,

privacy coins and ZK-protocols outperformed the broader market by an average of 150%. This established a strong "Privacy First" narrative that has carried into early 2026, positioning ZKP as the primary beneficiary of institutional capital looking for compliant yet private infrastructure.

\

What Is the Token Used for?

The ZKP token is the native utility and governance token of the zkPass ecosystem, serving as the essential infrastructure for private data verification. Its primary functions include:

1. Settlement Medium: ZKP is the native functional unit required for proof settlement and verifier execution within the zkPass ecosystem.

2. Validator Collateral: Validators post ZKP as operational collateral to ensure network correctness, uptime, and reliability.

3. Network Credits: ZKP operates as on-chain credits for recording and accounting network contributions, including verifiable computation and integrations.

4. Service Access: Used by enterprises and developers to interface with zk-native verification APIs and privacy-preserving data infrastructure.

5. Cross-System Verifiability and Governance: ZKP supports decentralized coordination and acts as the trust layer linking verifiable systems, while sustaining audits and other non-profit maintenance activities.

What Is the zkPass (ZKP) Tokenomics?

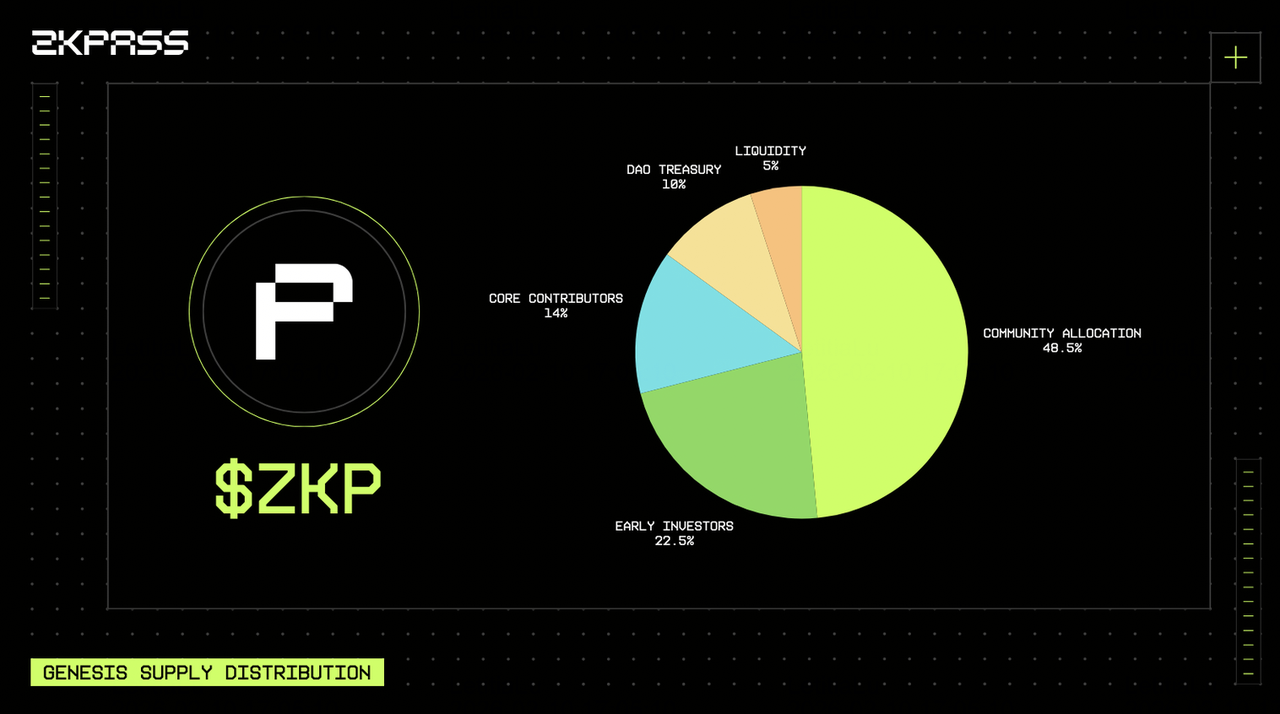

The zkPass (ZKP) tokenomics are designed to align the interests of all participants while ensuring long-term protocol stability and scarcity. Issued as an

ERC-20 token on the

Ethereum network and compatible across multiple chains via

LayerZero, the total supply is capped at 1,000,000,000 (1 billion) ZKP tokens.

Source: ZKP Tokenomics

The specific allocation and vesting schedules are as follows:

• Early Investors - 22.5%: Allocated to strategic and institutional partners who supported early-stage development. These tokens have a 12-month cliff followed by 18-month linear vesting.

• Core Contributors - 14.0%: Reserved for founding members, engineers, and researchers. This allocation features a 24-month cliff followed by 24-month linear vesting to ensure long term alignment.

• DAO Treasury - 10.0%: Dedicated to long-term network sustainability and ecosystem grants. These tokens vest linearly over 5 years.

• Liquidity - 5.0%: 100% unlocked at TGE to ensure market liquidity and network bootstrapping.

zkPass also implements a Deflationary Mechanism where a portion of every verification fee is permanently burned. Additionally, unallocated tokens from the 450-day auction phases are burned daily, creating consistent upward pressure as demand for zkTLS increases.

How to Buy and Trade zkPass (ZKP) on BingX

Whether you are looking to accumulate ZKP for longer-term exposure to the zkTLS narrative or trade short-term volatility driven by ecosystem developments, BingX provides access to ZKP through both spot and futures markets. With

BingX AI integrated directly into the trading interface, traders can also reference real-time market insights to support more informed entry and risk management decisions.

1. Buy or Sell ZKP on the Spot Market

If your goal is to buy and hold ZKP or enter during pullbacks, the BingX Spot Market offers the most straightforward approach.

Step 2: Before placing an order, click the AI icon on the chart to activate BingX AI. The tool highlights key support and resistance levels, potential breakout zones, and suggested price ranges based on recent market behavior.

Step 3: Choose a

market order for immediate execution or a limit order at your preferred price. Once filled, your ZKP will appear in your BingX wallet, where it can be held or transferred externally.

2. Trade ZKP with Leverage on Futures

For more active traders,

BingX Futures allows you to go long or short on ZKP, making it possible to trade both upward and downward price movements during periods of heightened volatility.

Step 1: Search for

ZKP/USDT in the BingX Futures section.

Step 2: Activate BingX AI to analyze short-term momentum, volatility, and trend strength, helping identify potential entry and exit zones.

4 Key Considerations Before Investing in ZKP

While zkPass represents a significant step forward in privacy-preserving verification, investors should consider the following factors before taking exposure to the ZKP token:

1. Adoption Cycle: ZKP’s long-term value depends on how widely zkTLS is adopted by dApps, enterprises, and institutions. Although the Institutional Suite pilot launched in Q1 2026 shows early traction, enterprise adoption typically progresses at a slower and less predictable pace.

2. Vesting and Supply Pressure: Investors should closely monitor the token unlock schedule. A meaningful portion of early investor allocations will vest throughout 2026 and 2027, which may introduce periodic sell-side pressure during market weakness.

3. Regulatory Environment: As a privacy-focused protocol, zkPass operates within an evolving regulatory landscape. Changes in KYC, data protection, and compliance requirements, including frameworks such as GDPR, could influence how the protocol is adopted or constrained across jurisdictions.

4. Competitive Landscape: The zkTLS and privacy infrastructure space is becoming increasingly competitive. While zkPass benefits from first-mover positioning and backing from major investors such as Binance Labs and Sequoia, sustained market leadership will depend on execution, adoption, and ecosystem growth.

Final Thoughts: Is zkPass (ZKP) a Good Investment in 2026?

As of February 10, 2026, zkPass is positioned as a "structural play" rather than a speculative one. With a live mainnet, an active 450-day deflationary auction, and a suite of institutional partners in banking and healthcare, the protocol has moved beyond the "hype" phase into real-world utility.

For investors looking for exposure to the Privacy Oracle and Identity (DID) sectors, ZKP offers a unique value proposition: it is the only major protocol currently capable of turning any HTTPS website into a verifiable data source without the website's permission. If Web3 continues its move toward compliance and real-world asset (RWA) integration in 2026, zkPass could well be the invisible infrastructure that makes it all possible.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in any cryptocurrency.

Related Reading