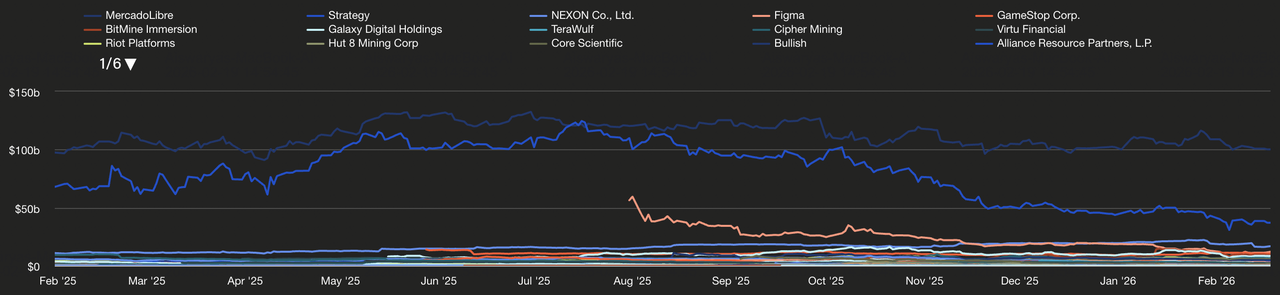

Market caps of leading Bitcoin treasury companies | Source: TheBlock

The narrative of

Bitcoin as a corporate reserve asset has matured into a sophisticated financial sector in early 2026. No longer a speculative experiment, the Bitcoin Treasury model, pioneered by Michael Saylor and

MicroStrategy (now Strategy), has evolved into what analysts call Treasury 2.0. This new phase moves beyond simple

HODLing toward active balance sheet management, where companies use Bitcoin to generate yield, issue digital credit, and hedge against traditional banking instability.

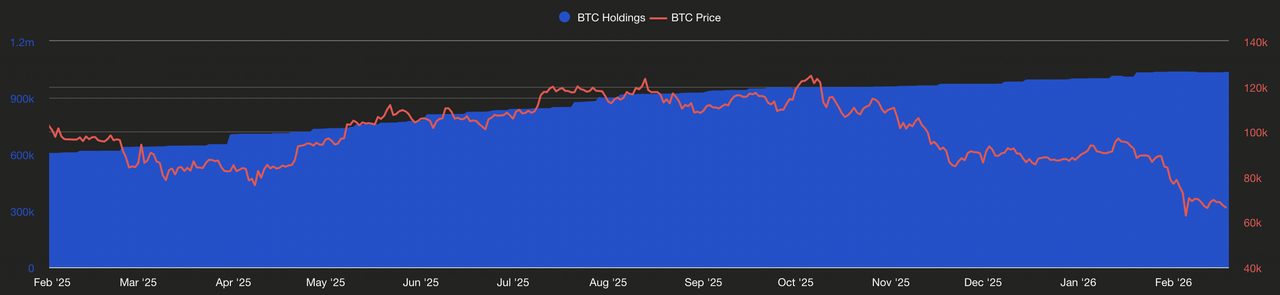

As of February 2026, public companies collectively hold over 1.13 million BTC, representing approximately 5.4% of the total supply. Despite a volatile month that saw Bitcoin prices consolidate around $67,000, institutional conviction remains at an all-time high.

This article identifies the top 10 public companies by Bitcoin holdings, detailing how these corporate BTC whales are redefining modern finance.

The Corporate Bitcoin Rich List: Top 10 Public BTC Holders

Cumulative Bitcoin treasuries vs. BTC price | Source: TheBlock

| Rank |

Company |

Ticker |

Country |

BTC Holdings |

Today's Value ($67k) |

| 1 |

Strategy (MicroStrategy) |

MSTR |

🇺🇸 US |

717,131 |

$48.16 B |

| 2 |

MARA Holdings |

MARA |

🇺🇸 US |

53,250 |

$3.57 B |

| 3 |

Twenty One Capital |

XXI |

🇺🇸 US |

43,514 |

$2.92 B |

| 4 |

Metaplanet Inc. |

3350.T |

🇯🇵 JP |

35,102 |

$2.36 B |

| 5 |

Bitcoin Standard Treasury |

CEPO |

🇺🇸 US |

30,021 |

$2.01 B |

| 6 |

Bullish |

BLSH |

🇺🇸 US |

24,300 |

$1.63 B |

| 7 |

Riot Platforms |

RIOT |

🇺🇸 US |

18,005 |

$1.21 B |

| 8 |

Coinbase Global |

COIN |

🇺🇸 US |

14,548 |

$976.8 M |

| 9 |

Hut 8 Corp |

HUT |

🇺🇸 US |

13,696 |

$919.8 M |

| 10 |

CleanSpark Inc. |

CLSK |

🇺🇸 US |

13,513 |

$907.5 M |

Data as of Feb 19, 2026. Holdings are estimated based on latest SEC filings and company disclosures.

1. Strategy (MSTR)

Strategy's Bitcoin holdings vs. MSTR stock | Source: TheBlock

Strategy, formerly MicroStrategy, has cemented itself as the most leveraged corporate Bitcoin vehicle in the public markets, holding 717,131 BTC, over 3.4% of Bitcoin’s fixed 21 million supply, accumulated at a total cost of $54.52 billion at an average $76,027 per BTC. In February 2026, the firm formally repositioned as a Bitcoin Operating Company, financing ongoing accumulation through common equity issuance and its STRC preferred stock, including a $168.4 million purchase of 2,486 BTC in a single week. Despite Bitcoin trading near $68,000, placing the treasury at an unrealized loss of roughly $5.7 billion, Strategy’s stock briefly traded at a compressed 0.95× mNAV, reinforcing its role as a high-beta, balance-sheet-driven proxy for Bitcoin exposure rather than a conventional operating business.

2. MARA Holdings (MARA)

MARA Holdings is one of the largest

publicly listed Bitcoin miners and has increasingly positioned itself as a Bitcoin treasury-first operator, retaining 100% of

mined BTC rather than selling into the market. As of early 2026, MARA holds 53,250 BTC, nearly doubling its treasury year over year, while generating $252 million in quarterly revenue, a 92% gain YoY, and swinging to $123 million in net profit from a loss a year earlier. The company operates large-scale mining and data-center infrastructure across North America and internationally, with a strategy centered on expanding hash rate, securing long-term power capacity, and treating Bitcoin as a core reserve asset instead of working capital, making MARA a structurally leveraged equity proxy for Bitcoin price cycles and mining economics.

3. Twenty One Capital (XXI)

Twenty One Capital emerged in late 2025 as a Bitcoin-native public company following its NYSE listing via a SPAC merger with Cantor Equity Partners, trading under the XXI ticker. Backed by

Tether, Bitfinex, and SoftBank, the firm holds 43,514 BTC, worth roughly $4.0–4.1 billion at early-2026 prices, ranking it among the top three corporate Bitcoin holders globally. Led by Strike founder Jack Mallers, Twenty One is structured around capital-efficient Bitcoin accumulation and Bitcoin-only financial services spanning brokerage, lending, and capital markets, with plans to align shareholder value directly to Bitcoin through on-chain

proof-of-reserves and Bitcoin-denominated performance metrics rather than fiat earnings, positioning XXI as a pure-play equity bridge between traditional capital markets and the Bitcoin economy.

4. Metaplanet Inc. (MPJPY)

Metaplanet Inc. has rapidly transformed into Asia’s most aggressive corporate Bitcoin treasury, holding 35,102 BTC, worth roughly $2.3–2.4 billion, making it the largest public Bitcoin holder in Japan and among the top globally. Since pivoting in April 2024, Bitcoin now drives 95% of revenue, with FY2025 revenue surging 738% YoY to ¥8.9 billion and operating profit jumping 1,700% to ¥6.3 billion, largely from Bitcoin options and income strategies. While accounting rules forced a ¥102.2 billion or $665 million non-cash impairment loss amid price volatility, Metaplanet has reaffirmed a long-term accumulation plan targeting 210,000 BTC or 1% of total supply, positioning the firm as a regulated, yen-denominated proxy for Bitcoin exposure in Asian public markets.

5. Bitcoin Standard Treasury Company (CEPO)

Bitcoin Standard Treasury Company is a Bitcoin-native treasury vehicle led by cryptography pioneer Adam Back, designed to give institutions direct, balance-sheet-level Bitcoin exposure without rehypothecation or yield risk. Ahead of its planned Nasdaq listing via a SPAC merger, the company holds 30,021 BTC, sourced from 25,000 BTC contributed by founders and 5,021 BTC from early investors, placing it among the top five corporate Bitcoin holders globally. Backed by a capital structure that combines a bitcoin-denominated PIPE with up to $1.5 billion in fiat financing, the firm targets rapid expansion beyond 50,000 BTC, while emphasizing fully unencumbered, pristine Bitcoin collateral, regulated custody, and conservative treasury management aligned with long-term Bitcoin Standard monetary principles.

6. Bullish (BLSH)

Bullish is an institutionally focused digital asset exchange that operates with a sizable Bitcoin treasury of 24,300 BTC, positioning it among the larger corporate holders globally. Following its NYSE listing in 2025 under BLSH at a valuation of roughly $13 billion, Bullish uses its balance sheet as part of a Treasury 2.0 model, actively managing risk while deploying BTC to support deep spot and derivatives liquidity, margin efficiency, and continuous price discovery for professional traders. As a regulated venue pursuing licenses such as New York’s BitLicense, Bullish treats Bitcoin not as a passive reserve but as core market infrastructure, tightly integrated into its trading, clearing, and capital management operations.

7. Riot Platforms (RIOT)

Riot Platforms is one of North America’s largest publicly traded Bitcoin miners, operating mega-scale facilities in Texas and holding 18,005 BTC, worth roughly $1.2 billion at February 2026 prices. With a deployed

hash rate of 38.5 EH/s and access to 1.4 GW of power capacity, Riot combines large-scale mining with disciplined treasury management, selectively selling BTC during periods of hashprice compression while retaining a sizable long-term reserve. Beyond mining, Riot is increasingly positioning its Texas infrastructure for

AI and high-performance computing (HPC) workloads, a pivot that activist investors estimate could unlock $9–21 billion in incremental equity value, reinforcing Riot’s role as a core digital-infrastructure and Bitcoin-levered play for the 2026 cycle.

8. Coinbase Global (COIN)

Coinbase Global operates at the center of Bitcoin’s institutional plumbing, serving as custodian for more than 80% of U.S.

spot Bitcoin ETF assets while separately holding 14,548 BTC on its own corporate balance sheet, fully segregated from client funds. This treasury reflects direct balance-sheet conviction, reinforced by a $39 million strategic BTC purchase in Q4 2025 during a consolidation phase, and complements Coinbase’s role as the industry’s primary liquidity and price-discovery hub across spot, derivatives, and custody. With audited cold-storage infrastructure and dominant institutional flows running through its platform, even modest treasury actions by Coinbase can carry outsized signaling power for market sentiment and liquidity conditions.

9. Hut 8 Corp (HUT)

Hut 8 Corp. operates a vertically integrated digital-infrastructure platform that blends Bitcoin mining with AI and high-performance computing, while maintaining a substantial 13,696 BTC treasury, valued around $1.5 billion. The company controls 1,020 MW of energized capacity with an 8.65 GW development pipeline, enabling revenue diversification beyond mining into compute-intensive workloads such as AI data centers, including projects like River Bend (Louisiana). Financially, Hut 8 generated $668 million TTM revenue with $206 million net income, reflecting the scalability of its energy-backed model; by monetizing power, data centers, and compute while retaining a sizable BTC reserve, Hut 8 positions itself as a hybrid infrastructure and Bitcoin treasury play for the 2026 cycle.

10. CleanSpark Inc. (CLSK)

CleanSpark Inc. is a large-scale, energy-first Bitcoin miner holding 13,513 BTC, valued at around $1.0 billion at early-2026 prices, while aggressively expanding its U.S. power and data-center footprint. As of January 2026, CleanSpark operated 50.0 EH/s of peak hashrate with fleet efficiency near 16.1 J/TH, produced 573 BTC in the month, and controlled 1.8 GW of contracted power with 808 MW utilized. The company is scaling into Texas with transmission-level campuses, up to 600 MW in Brazoria County plus 285 MW in Austin County, funded by a strong balance sheet with over $450 million cash reported late 2025 and selective BTC sales, positioning CleanSpark as a capital-disciplined miner leveraging sustainable energy and compute infrastructure for the 2026 cycle.

How to Trade Bitcoin Like the Whales on BingX

Leverage

BingX AI-driven insights and professional-grade tools to mirror the accumulation and trading strategies used by the world's largest corporate treasuries.

Option 1: Spot Trading for Long-term Bitcoin Ownership

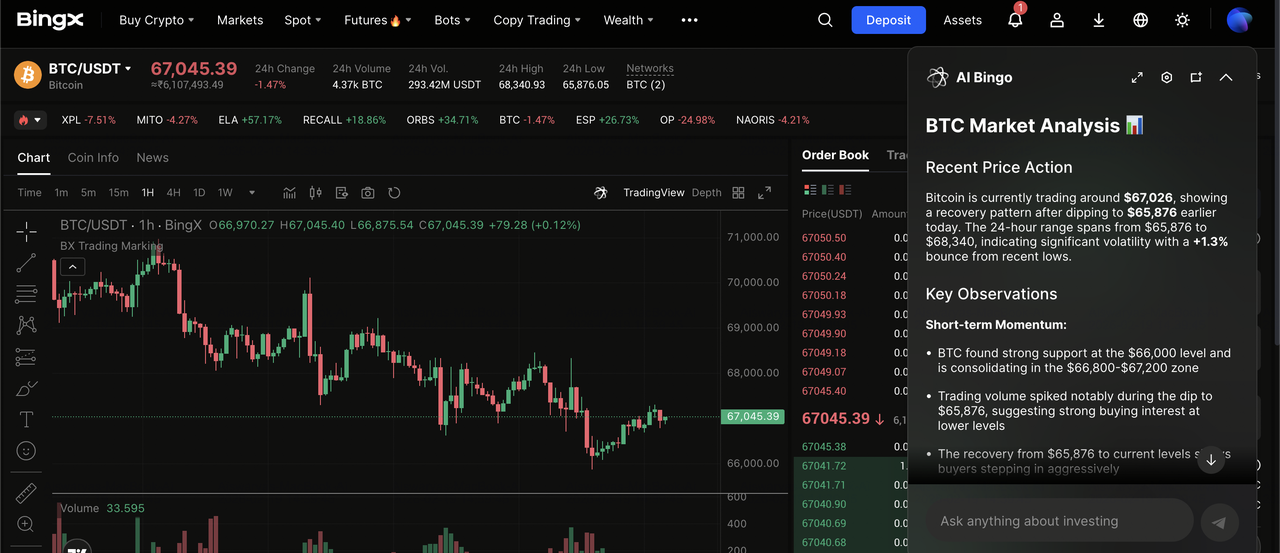

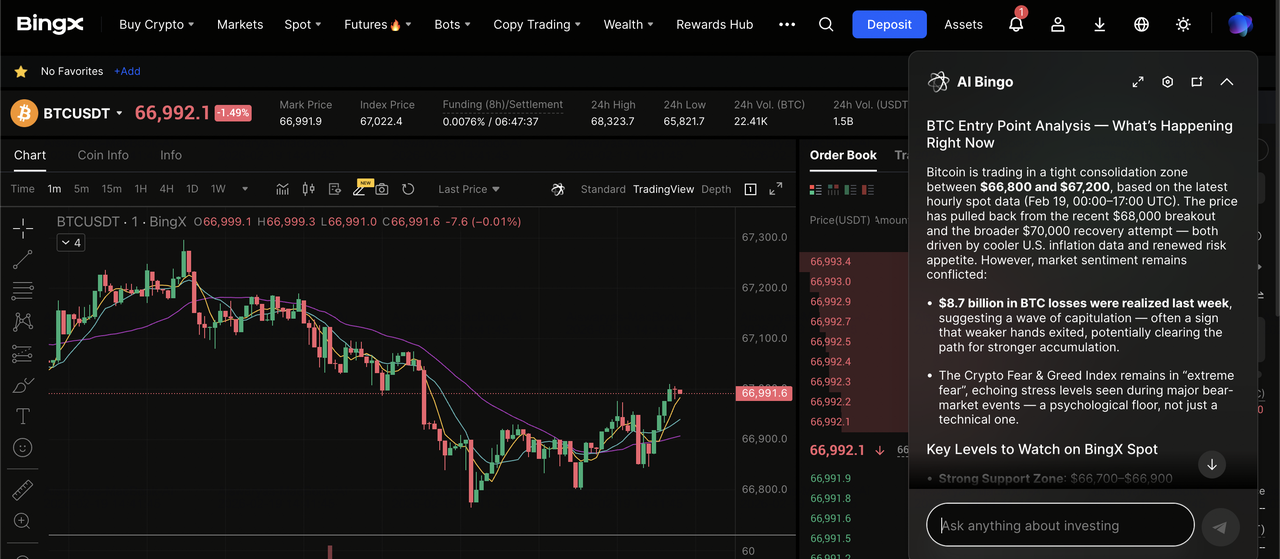

BTC/USDT trading pair on the spot market featuring BingX AI insights

The BingX spot market is best for investors who want to own the underlying asset and hold it in a secure wallet, similar to MicroStrategy’s HODL strategy.

1. Log In: Access your BingX account and navigate to the

Spot trading interface.

2. Search BTC: Type

BTC/USDT in the asset search bar to open the trading pair.

3. Execute Order: Select Market Order for an instant purchase or Limit Order to set a specific entry price.

4. Secure Holdings: Confirm the transaction to see your BTC balance updated in your BingX Fund Account.

Learn more about how to

buy Bitcoin (BTC) on BingX in our beginner's guide.

Option 2: Recurring Buy for Strategic Bitcoin DCA

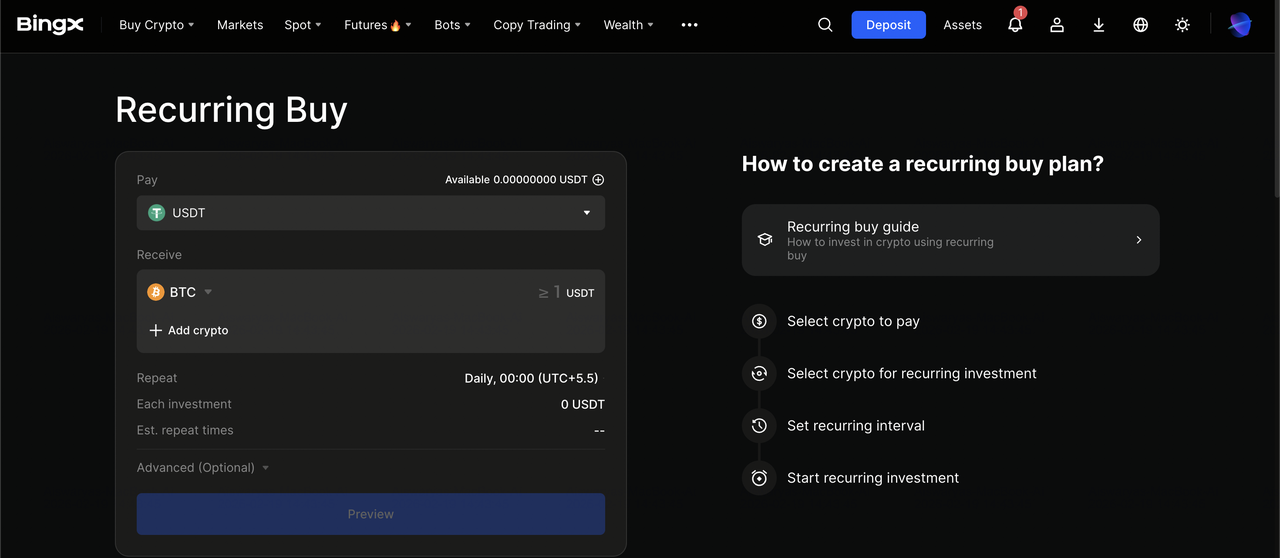

DCA Bitcoin on Recurring Buy

Ideal for mimicking institutional accumulation by buying fixed amounts at regular intervals to lower your average entry price.

2. Set Parameters: Choose BTC as your target and select

USDT as your payment currency.

3. Define Frequency: Set your investment amount and choosing a schedule, such as Hourly, Daily, Weekly, or Monthly.

4. Activate Plan: Review the details and click Confirm to let BingX AI execute your buys automatically.

Option 3: Bitcoin Futures Trading for Volatility Management

BTC/USDT perpetuals on the futures market with BingX AI insights

Designed for advanced traders looking to capitalize on whale-induced price swings using high-leverage contracts.

1. Transfer Funds: Move USDT from your Fund Account to your

Futures Account.

3. Analyze Trends: Use BingX AI signals to identify liquidity clusters and potential whale entry zones.

4. Set Leverage and Risk: Choose your leverage of up to 150x and strictly set

Stop-Loss and Take-Profit orders before opening your position.

What Are the Top 5 Risks for Corporate Bitcoin Treasuries in 2026?

As the Bitcoin Treasury model matures, boards and investors must navigate a high-stakes environment where balance sheet volatility directly impacts equity valuations and operational survival.

1. mNAV Inversion and the Broken Flywheel

When a company’s stock price falls below the value of its Bitcoin holdings, known as trading at a discount to Net Asset Value (mNAV), it signals a broken flywheel. For firms like

Strategy (MSTR), which hit a record 0.85x mNAV on February 6, 2026, this inversion prevents the company from issuing new equity to buy more BTC without diluting existing shareholders, effectively stalling its growth engine.

2. Miner Underwater Production Costs

The profitability threshold for Bitcoin miners has shifted dramatically in 2026. With the global average production cost now estimated at $80,497 per BTC, according to Cambridge data, many operators are currently underpaid with Bitcoin trading near $67,000 as of February 2026. This creates a risk of miner capitulation, where firms are forced to dump their treasury reserves to cover electricity and debt obligations, adding massive sell pressure to the market.

3. Strategic Double-Leverage Trap

Many Digital Asset Treasuries (DATs) have moved beyond simple cash-to-BTC conversions to using convertible debt and preferred equity. This creates a double-leverage risk: the company’s stock is more volatile than Bitcoin itself; for instance, MSTR’s Bitcoin Beta reached 1.34 in early 2026. In a downturn, the stock often crashes 1.6x faster than the underlying asset, potentially triggering margin calls on Bitcoin-backed loans.

4. Fair Value Accounting P&L Whiplash

Under 2026 accounting standards, public companies must measure Bitcoin holdings at fair value every quarter. This requirement introduces extreme reporting whiplash. Even if a company never sells, a 20% price drop results in massive unrealized paper losses, totaling over $10 billion for the top 10 treasuries in February 2026 alone, which can scare away traditional institutional investors focused on steady earnings per share.

5. Custodial and Governance Concentration

Concentration risk is no longer just about the asset; it’s about where it’s held. With over 1.1 million BTC held by public firms, and a significant portion managed by a single custodian, Coinbase Prime, any technical failure, regulatory freeze, or key ceremony error at a major provider could paralyze the liquidity of the entire corporate sector, creating a systemic black swan event.

Conclusion: Are Bitcoin Treasuries the New Era of Corporate Finance?

The 2026 data indicates that Bitcoin has transitioned from a speculative corporate experiment into a strategic pillar of global institutional finance. As Treasury 2.0 models become the standard, public companies are no longer just holding assets; they are actively integrating Bitcoin into their operational infrastructure and using specialized financial instruments, like STRC preferred stock, to scale their balance sheets.

The resulting institutional supply shock, driven by high-conviction entities like Strategy and Metaplanet, suggests that the competition for the remaining circulating supply will likely define the next phase of the market cycle. Moving forward, the success of these Bitcoin Treasury Companies (DATCos) will depend on their ability to manage complex risks and maintain liquidity through evolving macroeconomic shifts.

Risk Reminder: Investing in or trading digital assets involves significant market risk. Corporate Bitcoin strategies often involve high leverage and can lead to extreme stock price volatility. Always perform your own research (DYOR) and consider your risk tolerance before engaging in crypto-related financial activities.

Related Reading