The narrative of

Solana (SOL) has shifted into high gear in 2026. Following the full mainnet deployment of the Firedancer validator client and the activation of the

Alpenglow protocol upgrade, the network has achieved its long-awaited goal of 1 million transactions per second (TPS). With block finality now averaging a staggering 150 milliseconds, Solana has transitioned from a high-performance retail chain to the primary settlement layer for institutional DeFi and

real-world assets (RWAs).

As of February 2026,

SOL maintains a dominant market capitalization exceeding $46 billion. The ecosystem has moved beyond simple token transfers to a world of embedded finance, where Solana Actions and Blinks allow users to execute on-chain trades directly through shareable links in social media feeds.

This guide provides an exhaustive overview of the 10 best Solana wallets in 2026, evaluating their roles in security, liquidity access, and technical compatibility with the modern

SVM (Solana Virtual Machine).

What Are the 10 Best Solana Wallets to Use in 2026?

As the

Solana ecosystem reaches peak scalability, the following wallets have emerged as leaders based on security architecture, Token-2022 compatibility, and protocol-level integration.

1. BingX

BingX has evolved into the ultimate hybrid trading ecosystem for the modern Solana investor. At its core, BingX serves as a high-liquidity hub where

BingX Wealth offers SOL holders a Simple Earn program with estimated APRs of 7.2%–8.5%. With over 40 million global users and over 1,100 assets listed for trading, BingX offers a one-stop solution to trade and store Solana and Solana ecosystem tokens. Beyond standard storage, BingX introduces two revolutionary features for 2026:

• BingX ChainSpot: This CeDeFi gateway allows users to trade emerging on-chain Solana tokens directly from their BingX account using USDT. It eliminates the need for external Web3 wallets, manual bridging, or holding native SOL for gas, as all fees are auto-calculated and deducted in USDT.

• BingX TradFi: For investors looking to diversify beyond the crypto cycle, BingX TradFi integrates global traditional markets, including

commodities like

Gold and

Crude Oil, Forex, Stocks, and

Indices, into a single interface. Users can hedge their SOL positions with traditional safe havens using a unified USDT margin, reaching up to 500x leverage on over 50 underlying assets.

BingX empowers the hybrid trader of 2026, offering a seamless bridge where high-velocity Solana assets and global traditional instruments coexist within a single, AI-powered trading platform.

Best Suited For: Traders seeking a comprehensive and secure financial command center that blends DeFi accessibility with traditional market diversification.

2. Phantom

Phantom is the dominant Solana wallet by both usage and mindshare, trusted by over 20 million users globally as of 2026, and has evolved from a simple wallet into a full Web3 interaction layer. Beyond core self-custody, Phantom natively supports Solana staking, token swaps, NFT trading, and dApp access, while its Blinks (Blockchain Links) integration enables on-chain actions, such as signing transactions, staking SOL, or minting NFTs, directly from social surfaces like X (Twitter), Discord, and web embeds. Phantom’s PSOL (Phantom Staked SOL) product further lowers the barrier to participation by offering one-click liquid staking with instant liquidity, positioning Phantom as both an onboarding funnel and an execution hub for the Solana ecosystem, with expanding multi-chain reach across Solana,

Ethereum,

Bitcoin, and

Sui.

Key Consideration: Phantom’s deep social and multi-chain integrations across Solana, Ethereum, Bitcoin, and Sui increase convenience but require users to manage different fee models, signing flows, and staking risks across networks.

Best Suited For: Beginners and retail users who want a social-native, low-friction Solana wallet with built-in staking, swaps, and NFT support.

3. Solflare

Solflare is one of the longest-running native Solana wallets and has positioned itself as a security-first execution layer for advanced users as the network scales into the Firedancer era, supporting over 3 million active users and managing hundreds of millions of dollars in on-chain assets. Its standout Solflare Shield uses AI-powered transaction simulation to preview exact token inflows, outflows, approvals, and potential risks before signing, while deep staking integrations make it a preferred interface for

Jito MEV-enhanced staking, validator selection, and complex DeFi position management, reinforcing its reputation as a control-focused wallet rather than a purely social or consumer-facing one.

Key Consideration: Solflare exposes more granular on-chain data, simulations, and staking controls, which can feel overly technical for first-time Solana users.

Best Suited For: Power users, validators, and DeFi-native participants who need maximum security visibility, transaction simulation, and advanced staking control on Solana.

4. MetaMask with Solana Snaps

Following its 2025 multichain overhaul,

MetaMask extended beyond EVM-only rails by adding native Solana support via

Solana Snaps, allowing users to derive a Solana address directly from their existing Secret Recovery Phrase and manage SOL and SPL tokens alongside Ethereum accounts in a single interface. By 2026, the Solana Snap supports full dApp connectivity, token transfers, swaps, bridging, and transaction simulation, effectively turning MetaMask’s 100 million+ annual-user security stack, including malicious dApp detection and real-time alerts, into a cross-chain control layer that unifies Solana and EVM workflows without fragmenting custody.

Key Consideration: The MetaMask Solana Snap still has limited hardware wallet parity, notably lacking full Ledger-based Solana account support within the Snap environment.

Best Suited For: Ethereum-native users and multichain operators who want to manage SOL and EVM assets under one recovery phrase without adopting a separate Solana-first wallet.

5. Glow Wallet

Glow is a design-led, mobile-first Solana wallet that has carved out a niche by optimizing for speed, visual clarity, and frictionless NFT management, earning its reputation as the Apple-style wallet of the ecosystem. By 2026, Glow has become especially popular among iOS users, combining native Safari Mobile dApp connectivity, iCloud Keychain, encrypted backups, and instant push notifications for on-chain activity, while its signature Burn for SOL feature lets users permanently delete spam NFTs and reclaim 0.002 SOL per closed account in rent, turning wallet hygiene into a small but tangible yield.

Key Consideration: Glow is heavily optimized for mobile UX, and its desktop extension offers fewer advanced staking, validator, and DeFi controls than power-user wallets like Solflare.

Best Suited For: Mobile-first users and NFT collectors who want a fast, elegant Solana wallet with a clean gallery, spam cleanup tools, and seamless on-the-go dApp access.

6. Ledger

Ledger has become the institutional-grade standard for securing Solana assets, with devices like Ledger Stax and Ledger Flex purpose-built for high-value, high-frequency on-chain environments as Solana scales toward 100 million transactions per day. Its secure touchscreen signers use Clear Signing on a 2.8–3.7″ E-Ink display to show full transaction details, addresses, token movements, and permissions, before approval, materially reducing phishing and blind-signing risk, while Ledger Wallet (Ledger Live) now supports SOL, SPL tokens, staking, swaps, and Token Extensions, enabling long-term custody of advanced assets such as confidential RWAs entirely in cold storage.

Key Consideration: Using Ledger requires a physical signer and regular firmware/app updates to stay compatible with Solana protocol upgrades and new token standards.

Best Suited For: Long-term SOL holders, high-net-worth users, and security-first DeFi participants who demand hardware-isolated private keys and maximum transaction verification.

7. Trezor

Trezor is a privacy-leaning, open-source-first hardware wallet ecosystem trusted by over 2 million users and backed by more than 12 years in crypto security, with its February 2026 Trezor Suite update sharpening Solana support for devices like Trezor Safe 5, including in-app SOL management and native

SOL staking in Trezor Suite with a 0.01 SOL minimum, plus auto-compounding and up to 7% APY marketing guidance. It stands out for privacy controls such as Tor routing and backend options that reduce IP-level linkage during transaction broadcasting, while keeping signing strictly on-device and the software stack auditable for users who prefer transparent security over closed systems.

Key Consideration: For full Solana dApp/NFT/DeFi workflows, Trezor often relies on third-party wallet front-ends (it supports connecting to 30+ wallet apps), which adds an extra compatibility layer versus Solana-native wallets.

Best Suited For: Privacy-focused HODLers who want a fully open-source security posture with hardware-isolated keys, plus Suite-based SOL management and staking.

8. Atomic Wallet

Atomic Wallet positions itself as a mass-market, multi-chain yield hub, claiming 15,000,000 users worldwide and support for 1,000+ coins and tokens across 30+ blockchains, with built-in staking for 20+ PoS assets plus simple buy/swap flows for retail portfolios. On the Solana side, Atomic markets SOL staking yields around 5% APY and an easy Stake & Earn experience that’s closer to set-and-forget than Solana-native power tooling, while its security messaging emphasizes non-custodial local key storage and AES encryption for local data, alongside a headline $1,000,000 bug bounty initiative launched to harden the stack after prior security scrutiny.

Key Consideration: Atomic is strong on broad asset coverage and staking, but it doesn’t match Solana-first wallets on Solana-native features like Blinks, xNFT experiences, or deep DeFi/NFT controls.

Best Suited For: Retail users managing a diverse, multi-chain portfolio of 1,000+ assets who want a simple, consolidated staking-and-hold workflow rather than Solana power-user functionality.

9. Torus

Torus (now commonly integrated via Web3Auth) is built for frictionless Solana onboarding, letting users create a self-custodial, seedless wallet in one click using familiar logins like Google, Discord, Twitter, email, etc., while keeping key ownership non-custodial through threshold cryptography/MPC-style key shares. Instead of a single 12-word phrase, Torus splits the signing authority into multiple shares across a device factor + social login factor + network share, so access typically requires a threshold, e.g., 2-of-3 shares, meaning a compromised social account alone is not enough to drain funds without an additional factor. This model is designed to reduce key-loss and boost onboarding performance; Web3Auth even cites conversion lifts up to 64% when apps replace seed phrases with social-login flows.

Key Consideration: The seedless/threshold-share model changes the trust and recovery mental model, so advanced DeFi users may want to understand which factors/shares they control and how recovery works before using it as a primary wallet.

Best Suited For: Newcomers and Web2.5 users who want non-custodial Solana access without managing a 12-word phrase, using familiar logins plus multi-factor recovery.

10. Solana Seeker Seed Vault Wallet

The Solana Seeker Seed Vault Wallet is a hardware-backed, mobile-native Solana wallet built directly into the

Seeker phone, designed to eliminate the trade-off between security and usability that has long plagued mobile crypto. Developed with Solflare, it stores private keys inside a tamper-resistant Trusted Execution Environment (TEE) that operates independently from Android, meaning keys never touch the OS or third-party apps, even if the device is compromised. Transactions are authorized via a double-tap + fingerprint flow, providing hardware-level “clear signing” in a phone-native gesture, while deep integration with Solana dApp Store 2.0 featuring 100+ apps, human-readable Seeker IDs (.skr), and the non-transferable Seeker Genesis Token (SGT) turns the wallet into both a secure signer and an identity layer for airdrops, gated rewards, and ecosystem incentives tied to the upcoming

SKR token economy.

Key Consideration: Security and exclusivity are tightly coupled to the Seeker hardware, so advanced users must still safely back up the recovery phrase to recover funds if the device is lost or destroyed.

Best Suited For: Mobile-first Solana users who want

hardware-wallet-grade security without external devices, plus seamless access to dApps, airdrops, and ecosystem rewards directly from their phone.

How to Fund Your Solana Wallet with BingX

Powered by

BingX AI, the platform helps you buy SOL to fund your Solana wallet with greater precision during high-volatility periods.

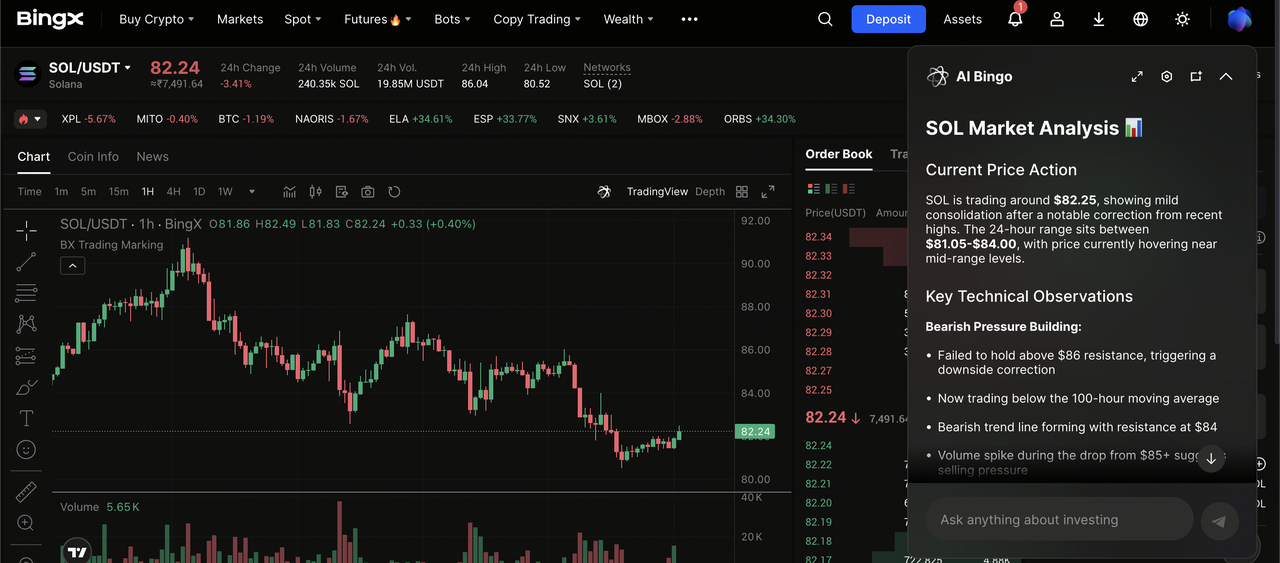

Buy and Hold SOL on the Spot Market

SOL/USDT trading pair on the spot market powered by BingX AI insights

1. Fund your Spot wallet with

USDT.

2. Navigate to the

SOL/USDT pair and use BingX AI to analyze key support levels.

3. Place a

Limit Order to accumulate SOL at your target price.

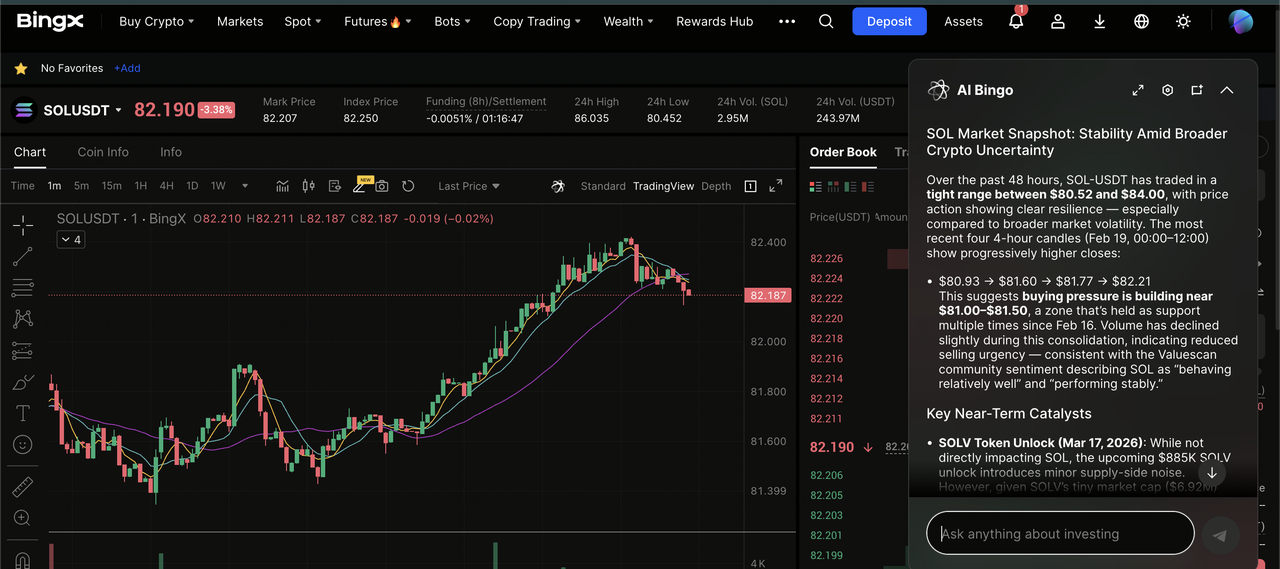

Trade SOL Futures with Leverage

SOL/USDT perpetuals on the futures market featuring BingX AI insights

In addition to buying and holding Solana, BingX also lets you trade Solana perpetuals on the

futures market.

2. Apply AI-Powered Risk Alerts to monitor for sudden liquidations or trend reversals.

3. Set automated

Stop-Loss and Take-Profit orders to protect your margin during the sub-second price moves of the Firedancer era.

How to Select the Best Solana Wallet for Your Needs

Selecting the right wallet requires a strategic balance between your daily transaction habits, long-term security goals, and your level of technical expertise within the Solana ecosystem.

• Security Architecture: Beyond storing SOL on your BingX hot wallet, you can also prioritize

Non-Custodial wallets where you hold the private keys; for high-value portfolios, ensure the software integrates with a physical hardware device like Ledger or Tangem for offline signing.

• Protocol Compatibility: Verify that the wallet supports the latest Token-2022 extensions and the Agave 2.0 validator standards to ensure successful transactions with modern assets and Firedancer-speed finality.

• Transaction Transparency: Look for Human-Readable transaction previews and scam-detection simulations like those in Solflare or Phantom that explain exactly what is entering or leaving your wallet before you sign.

• Native Ecosystem Support: If you are active in DeFi or NFTs, choose a wallet with built-in staking dashboards, NFT gallery views, and a native dApp browser or Solana Blinks integration.

• Account Management Tools: Seek out wallets with Rent Reclamation features that allow you to close empty token accounts and reclaim the SOL deposit (rent) that is often left behind after trading.

• Cross-Chain Flexibility: Decide if you prefer a Solana-First wallet for deep network features or a Multi-Chain wallet like MetaMask with Solana Snaps or Atomic Wallet to manage your SOL alongside

BTC and

ETH in one place.

Top 3 Considerations Before Choosing a Solana Wallet in 2026

Before finalizing your wallet choice, it is essential to consider the technical shifts occurring within the Solana network that directly impact security and transaction efficiency.

• Firedancer and Alpenglow Readiness: Ensure your wallet is optimized for the Agave 2.0 validator standards and the Alpenglow consensus protocol. This technical stack is what enables the network's 2026 sub-200ms transaction finality; an unoptimized wallet may experience lag or failed transaction simulations during periods of high cluster activity.

• Token-2022 and Transfer Hook Awareness: The modern Solana ecosystem relies on Token Extensions (Token-2022). High-utility tokens now frequently use Transfer Hooks to enforce royalties or compliance; if your wallet doesn't support these extensions, your transactions will fail to execute, or you may be unable to view your correct balance for newer RWA tokens.

• Dynamic Rent Recovery: While the cost to open an account is approximately 0.002 SOL, frequent traders can easily lock up several SOL in zombie accounts over time. Prioritize wallets like Glow or Phantom that feature native Rent Reclamation or Account Closing tools, allowing you to instantly claw back these refundable deposits once you've sold or transferred a token.

Final Thoughts: What's the Best Solana (SOL) Wallet to Use?

By early 2026, the Solana network has matured into a cornerstone of the global digital economy, driven by the unprecedented performance of the Firedancer era. Whether you prioritize the social-commerce versatility of Phantom, the institutional-grade security of Ledger, or the cross-market diversification capabilities of BingX, your choice of wallet serves as the primary gateway to your financial autonomy. Aligning your wallet selection with your specific needs, be it DeFi participation, NFT collection, or TradFi hedging, is essential for optimizing your interaction with this hyper-scaled ecosystem.

As you navigate these high-velocity markets, maintaining rigorous operational security remains paramount. Always safeguard your recovery phrases in offline environments and utilize "Clear Signing" features to verify transaction integrity before execution. It is vital to remember that all digital asset investments carry significant risk; the inherent volatility of the Solana ecosystem and the complexities of traditional finance instruments can lead to the partial or total loss of capital. Investors should conduct thorough due diligence and only allocate funds they are prepared to lose.

Related Reading