The narrative of

memecoins has reached a phase of Institutional Speculation in 2026. While the broader crypto market has matured, the Solana memecoin sector remains the primary engine for retail engagement and on-chain liquidity. Following the full deployment of the Firedancer validator client,

Solana’s sub-cent fees and instant finality have made it the undisputed home for high-frequency meme trading and autonomous

AI agents.

Market cap of leading Solana meme coins | Source: CoinGecko

Solana's dominance in the meme sector is no longer just about jokes; it is about attention markets. As of February 2026, Solana accounts for over 60% of all new token deployments, driven by the viral success of launchpads and the integration of AI-driven narratives. This guide analyzes the top 10 Solana meme coins currently defining the 2026 cycle.

What’s Driving Solana’s Memecoin Dominance in 2026?

Solana’s resilience in the face of shifting market cycles is powered by three distinct meme-pillars:

1. The Rise of AI-Agent Sovereignty: In 2026, memecoins are no longer just static images. Projects like

pippin and

Fartcoin utilize modular

AI frameworks like BabyAGI to interact with users 24/7 on social platforms, creating a living token economy that generates its own content and hype.

2. PolitiFi and Real-World Correlation: With the 2026 U.S. midterm elections approaching, PolitiFi assets have become high-beta proxies for political sentiment. Tokens like

TRUMP and

MELANIA trade with high correlation to news cycles, attracting professional traders who use them to hedge political outcomes.

3. Low-Friction Retail Onramps: The maturation of the

Pump.fun model and

BingX’s ChainSpot gateway has made it easier than ever for retail crypto traders to transition from traditional apps to the trenches of

Solana DeFi.

What Are the 10 Best Solana Memecoins to Watch in 2026?

As Solana’s high-throughput, low-fee blockchain continues to fuel viral token launches and rapid trading activity, these memecoins stand out in 2026 for their liquidity, community traction, and

on-chain momentum.

1. Official TRUMP (TRUMP)

Official TRUMP (TRUMP) remains the most liquid and capitalized asset in the PolitiFi niche, functioning as a real-time on-chain proxy for political and meme-driven risk appetite. As of February 2026, TRUMP trades around $3.52 with a fully diluted valuation of $3.5 billion, an unlocked market cap near $1.9 billion, and a circulating supply of 232.5 million tokens out of a fixed 1 billion max supply. Despite being down over 95% from its January 2025 all-time high of $75.35, the token still commands $110 million in daily trading volume giving it a 13.4% vol/market cap and a holder base of 647,000 wallets, underscoring deep liquidity and broad retail distribution.

2. Bonk (BONK)

Bonk (BONK) has transitioned from a one-off meme airdrop into a measurable utility and liquidity layer within the

Solana ecosystem. As of February 2026, BONK carries a market cap of roughly $575 million. The token is integrated across 400+ applications and tooling layers, including launchpads,

NFTs, payments, rewards, and trading bots, spanning 13 chains, while maintaining a broad holder base approaching 1 million wallets, reinforcing decentralized ownership. BONK’s deflationary design is now ecosystem-driven: protocol fees from products like LetsBonk.fun are recycled into buy-and-burn activity, and milestone burns, e.g., a planned 1 trillion BONK burn at 1 million holders, introduce a structural supply sink. Trading nearly 89% below its 2024 peak yet up nearly 7,000% from cycle lows, BONK increasingly behaves less like a pure meme and more like a high-beta Solana utility asset tied to network activity, retail participation, and meme-sector risk appetite.

3. pippin (PIPPIN)

pippin (PIPPIN) has emerged as a reference asset for the agentic memecoin category, combining speculative meme dynamics with a live autonomous AI agent operating natively on Solana. As of early 2026, PIPPIN trades around $0.45 with a market cap of $448 million. The project’s differentiator is not narrative alone: its AI agent autonomously posts and interacts on X using an open-source, state-driven framework, making PIPPIN one of the few memecoins where token value is directly tied to a continuously operating digital entity. With 35,600 holders and no emissions overhang, PIPPIN increasingly functions as the benchmark for AI-native memes, priced not just on virality, but on market confidence in autonomous, composable on-chain agents as a new crypto primitive.

4. Pudgy Penguins (PENGU)

Pudgy Penguins (PENGU) has evolved into one of the most commercially grounded meme ecosystems in crypto, blending mass-market brand traction with on-chain liquidity. As of February 2026, PENGU trades around $0.0072 with a market cap of $450 million. The token is backed by one of the largest retail audiences in Web3, with 850,000 on-chain holders, over 2.6 million global social followers, and 140 billion+ GIF views, while Pudgy Toys have sold more than 1.2M units across major retailers including Walmart, Target, and Walgreens, creating a rare Web2-to-Web3 revenue funnel. Utility extends beyond branding:

PENGU powers rewards in Pudgy World, has burned $34.9 million worth of tokens or 13.7% of supply, supports a dedicated Solana validator with 163,000 SOL staked, and now underpins real-world spending via the Pengu Visa Card, accepted at over 150 million merchants globally. Trading 88% below its 2024 peak yet nearly 2× off cycle lows, PENGU increasingly prices as a consumer-brand-anchored meme asset, where valuation is driven less by pure speculation and more by distribution scale, IP monetization, and sustained retail engagement.

5. dogwifhat (WIF)

dogwifhat (WIF) remains one of the purest liquidity-driven meme assets on Solana, with price action dictated almost entirely by sentiment, turnover, and cultural relevance rather than fundamentals. As of February 2026,

WIF trades near $0.23 with a market cap of $230 million and $84 million in daily volume, equivalent to 36% of its market cap, highlighting its role as a high-beta trading vehicle rather than a long-term yield or utility token. The WIF token's holder base of 248,000 wallets reflects broad, decentralized ownership. Despite sitting 95% below its 2024 peak of $4.85, WIF’s ability to sustain top-tier liquidity and repeated speculative rotations underscores its function as a benchmark pure meme asset, where valuation is a direct expression of collective belief in the hat, not cash flows, roadmaps, or narrative complexity.

6. The White Whale (WHITEWHALE)

The White Whale (WHITEWHALE) is a high-beta, narrative-first Solana memecoin that has quickly become a focal point for retail-led trading coordination rather than long-term utility. Launched in late 2025,

WHITEWHALE trades around $0.065 with a market cap of $65 million as of February 2026. Liquidity is moderate but active, with $6.5 million in 24h volume and a 10% vol/market cap, reflecting recurring speculative bursts tied to community trading events rather than organic demand. With 21,300 holders and zero transaction taxes, the token is optimized for fast, low-friction rotation on Solana DEXs, reinforcing its positioning as a protest-themed retail coordination asset. Down 67% from its January 2026 peak yet still far above launch levels, WHITEWHALE prices less as a meme brand and more as a sentiment gauge for short-term, community-driven risk appetite in the Solana meme microcap segment.

7. Moo Deng (MOODENG)

Moo Deng (MOODENG) is a high-velocity Solana memecoin whose value is driven almost entirely by viral culture and trading liquidity rather than utility. As of February 2026,

MOODENG trades with a market cap of $60 million, a fully circulating fixed supply of 990 million tokens, and no emissions or unlock risk. Despite being down 91% from its November 2024 peak, it remains highly liquid for its size, posting $21 million in daily volume, over 35% of its market cap, signaling frequent speculative rotation rather than passive holding. The holder base has grown to 68,000 wallets, reflecting broad retail distribution fueled by the meme’s real-world virality, which surpassed 1B+ views across social platforms. MOODENG’s evolution into a wholesome or charity-adjacent meme has helped sustain engagement post-hype, but its pricing behavior still tracks attention cycles and meme-sector sentiment, positioning it as a sentiment-sensitive, liquidity-first asset rather than a fundamentals-driven token.

8. Official Melania Meme (MELANIA)

Official Melania Meme (MELANIA) functions as a high-beta satellite asset within the Trump-themed PolitiFi complex, with price action tightly correlated to headline risk rather than fundamentals. As of February 2026,

MELANIA trades around with a market cap of $119 million, 98% of its 1.0 billion supply already circulating, and $11 million in daily volume, giving it a 9% vol/market cap, indicating moderate but reactive liquidity. The token is down 99% from its January 2025 peak of $13.73, yet remains actively traded by a large retail base of 226,000 holders. Historically, MELANIA has exhibited sharp, event-driven spikes, often 30%+ in short windows, around political appearances, media cycles, or Trump-adjacent narratives, frequently lagging or amplifying moves in the larger TRUMP token. In practice, MELANIA trades less as a standalone meme and more as a leveraged sentiment proxy, offering traders exposure to PolitiFi volatility with higher downside risk and weaker structural support than the sector’s primary benchmark.

9. Fartcoin (FARTCOIN)

Fartcoin (FARTCOIN) sits at the intersection of AI experimentation and absurdist meme culture on Solana, trading less on utility and more on narrative-driven liquidity. As of February 2026,

FARTCOIN trades near with a market cap of $194 million, a $29 million in daily volume, and a 15% vol/market cap, underscoring its role as an actively rotated meme asset rather than a passive hold. The token traces its origins to the Truth Terminal AI experiment, positioning it as a tongue-in-cheek example of AI-generated humor being directly financialized into a liquid market. Despite being down 93% from its January 2025 peak, it retains a sizable community of 161,000 holders, signaling persistent cultural resonance among developers and meme-native traders. In practice, FARTCOIN prices as an experimental meme beta, where valuation reflects engagement with AI-driven absurdism and Solana’s high-velocity trading culture rather than any expectation of protocol cash flows.

10. SPX6900 (SPX)

SPX6900 (SPX) trades as a satire-native proxy for macro sentiment rather than fundamentals, monetizing the irony of tokenizing the stock market into a single meme. As of February 2026,

SPX trades with a $335 million market cap , $18 million in 24h volume, and a 5.5% vol/market cap. Despite sitting 84% below its July 2025 peak of $2.28, the token retains a broad retail base of 226,000 holders and remains actively rotated during risk-on altcoin phases, as evidenced by recent double-digit price moves driven by volume spikes rather than news. Functionally, SPX prices as a

TradFi-meme crossover asset: its valuation tracks attention, irony, and momentum around macro narratives, not cash flows or index linkage, making it a liquid sentiment barometer for traders who want exposure to “market commentary” expressed through Solana meme liquidity.

How to Trade Solana Memecoins on BingX

With

BingX AI delivering real-time market insights and risk analytics, traders can navigate Solana memecoins across Spot, Futures, and on-chain markets with greater precision and control.

1. Buy, Sell, or Hold Solana Meme Tokens on the Spot Market

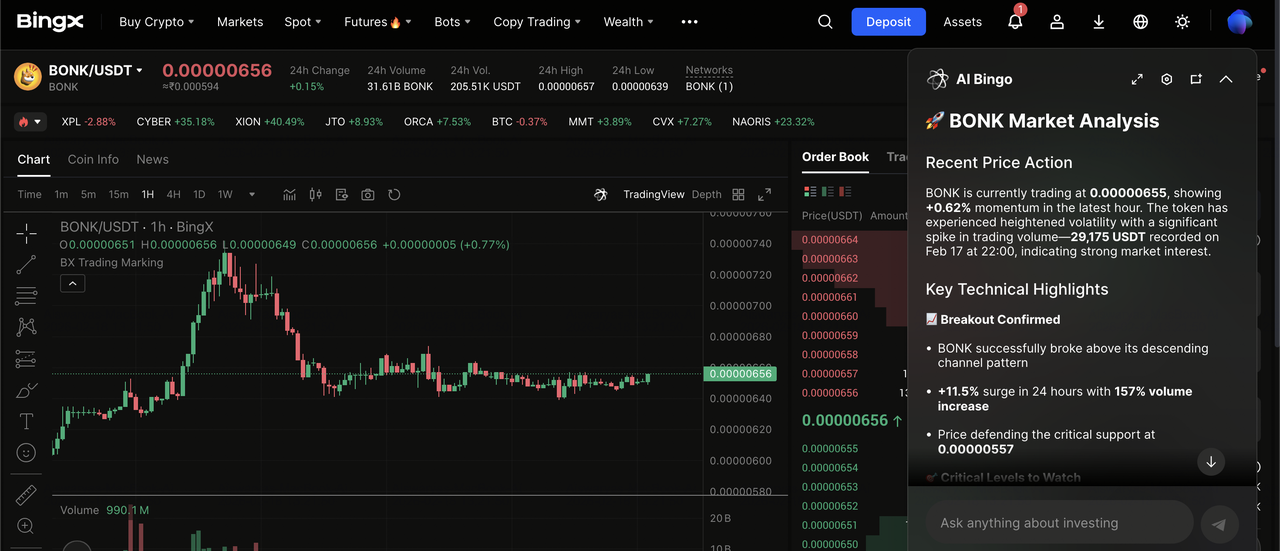

BONK/USDT trading pair on the spot market with BingX AI insights

Ideal for projects with established communities like BONK or PENGU.

1. Navigate to the BingX Spot Market.

3. Use BingX AI tools to set limit orders at historical support levels.

2. Go Long or Short on Solana Memes with Leverage on the Futures Market

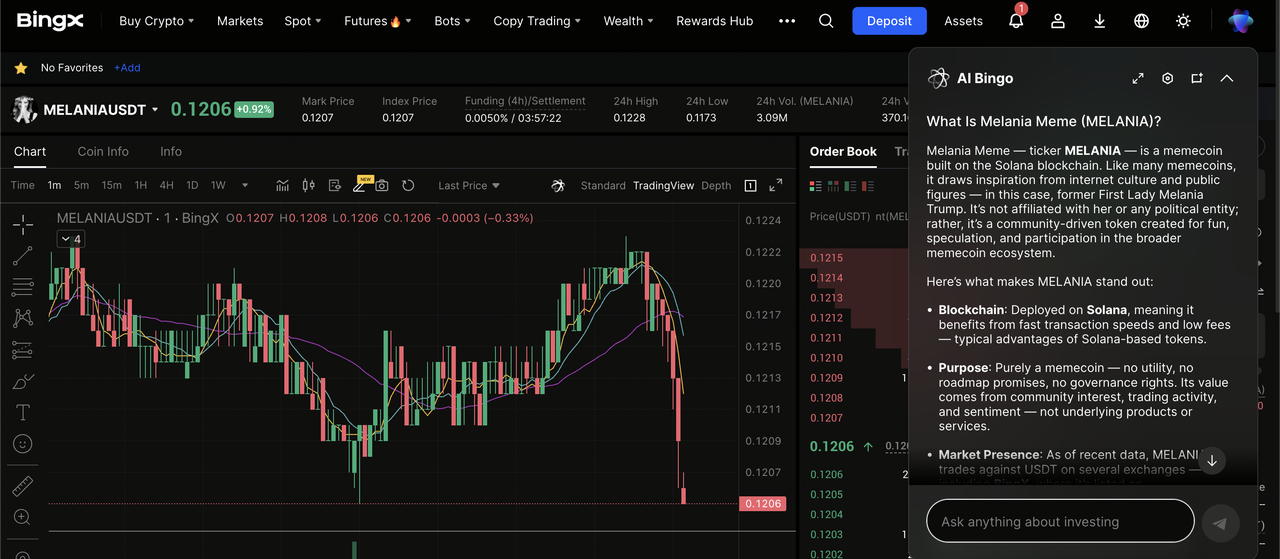

MELANIA/USDT perps on the futures market featuring BingX AI insights

For assets like PIPPIN or MELANIA, where price swings are violent.

1. Open the BingX Futures terminal.

3. Manage risk with Guaranteed

Stop-Loss orders to protect against flash wick volatility.

3. Trade Trending Solana Memecoins on BingX ChainSpot

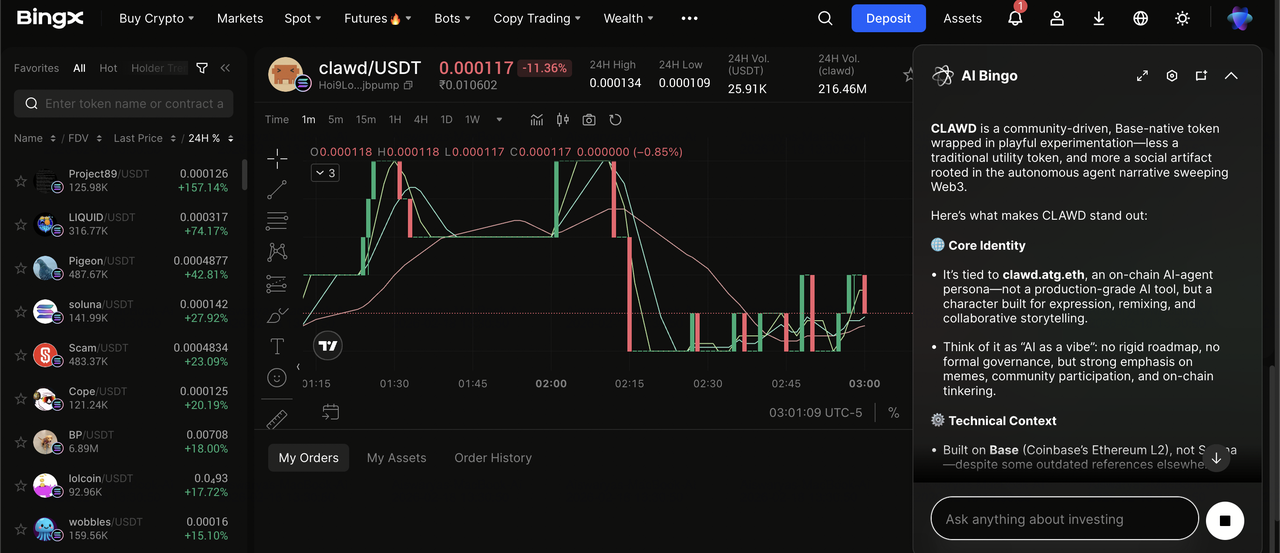

CLAWD/USDT on ChainSpot with BingX AI insights

ChainSpot is ideal for early exposure to newly trending or on-chain Solana meme tokens before broader exchange adoption.

1. Access BingX ChainSpot under the Spot tab on the website.

2. Discover trending Solana meme tokens like

CLAWD/USDT using on-chain liquidity and volume indicators.

3. Leverage BingX AI-powered signals to assess momentum, manage slippage, and execute trades directly on-chain.

Top 5 Risk Management Strategies When Trading Solana Memecoins

Success in the high-velocity Solana memecoin market requires a disciplined approach to capital preservation and a sharp eye for on-chain security.

1. Strategic Position Sizing: Limit exposure by never allocating more than 1–2% of your total portfolio to a single memecoin, ensuring that a single rug pull or crash doesn't jeopardize your entire stack.

2. The Cost Basis Exit Strategy: Implement the house money rule; sell 50% of your position once the price doubles (a 2x move) to recover your initial investment and let the remaining tokens run risk-free.

3. Mandatory Contract Verification: Always utilize on-chain security tools like RugCheck or Birdeye to verify that liquidity is permanently locked and that the contract ownership has been renounced by the developers.

4. Monitor Token Unlocks and Vesting: Track scheduled supply increases, such as the 80% supply lock on Official TRUMP, as significant unlocks can create massive overhead sell pressure.

5. Analyze Liquidity-to-Market-Cap Ratios: Prioritize tokens with high 24-hour volumes relative to their market caps, as low liquidity can lead to slippage traps where you cannot exit your position during a sell-off.

Final Thoughts: Should You Invest in the Solana Memecoin Ecosystem in 2026?

By early 2026, the Solana memecoin ecosystem has transitioned from a landscape of random speculation into a more structured market dominated by cultural proxies and autonomous AI agents. As the network matures through infrastructure milestones like Firedancer, the meme economy has become a sophisticated proving ground for internet culture, where assets like TRUMP and PIPPIN capture global attention and liquidity with unprecedented speed. For traders, Solana offers a high-performance environment that remains the primary engine for retail discovery and community-driven innovation.

However, participants must recognize that the speed of the Solana network is a double-edged sword. While it enables rapid gains, it also accelerates the pace of market corrections and the proliferation of fraudulent rug pulls. Memecoins remain high-risk, speculative assets with no intrinsic value. Success in this sector requires strict adherence to risk management protocols, thorough on-chain due diligence, and the discipline to invest only what you can afford to lose.

Related Reading